Bitcoin’s value has made a brand new all-time excessive yesterday, as Trump’s inauguration has flooded the crypto market with optimism.

Nevertheless, in occasions of euphoric expectations, warning and danger administration are suggested.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Each day Chart

On the every day chart, the asset has as soon as once more entered a bullish part after rebounding from the $92K stage. The $100K line has been damaged to the upside and even retested earlier than the market made a brand new all-time excessive across the $110K mark.

At the moment, there may be extra potential for upward motion, because the $100K stage is performing as a powerful help, and the RSI is displaying clear bullish momentum. In consequence, if the $100K stage holds, a rally larger towards the $120K space might be anticipated within the brief time period.

The 4-Hour Chart

Trying on the 4-hour chart, it’s evident that the asset’s breakout above the massive falling wedge sample has paved the way in which for a brand new all-time excessive. The upper boundary of the sample has additionally been retested twice and is pushing the worth larger.

In the meantime, the market’s fast rejection from the $108K stage is in some way worrying and will result in a reversal if the worth loses the $100K help line within the coming days.

On-Chain Evaluation

By Edris Derakhshi (TradingRage)

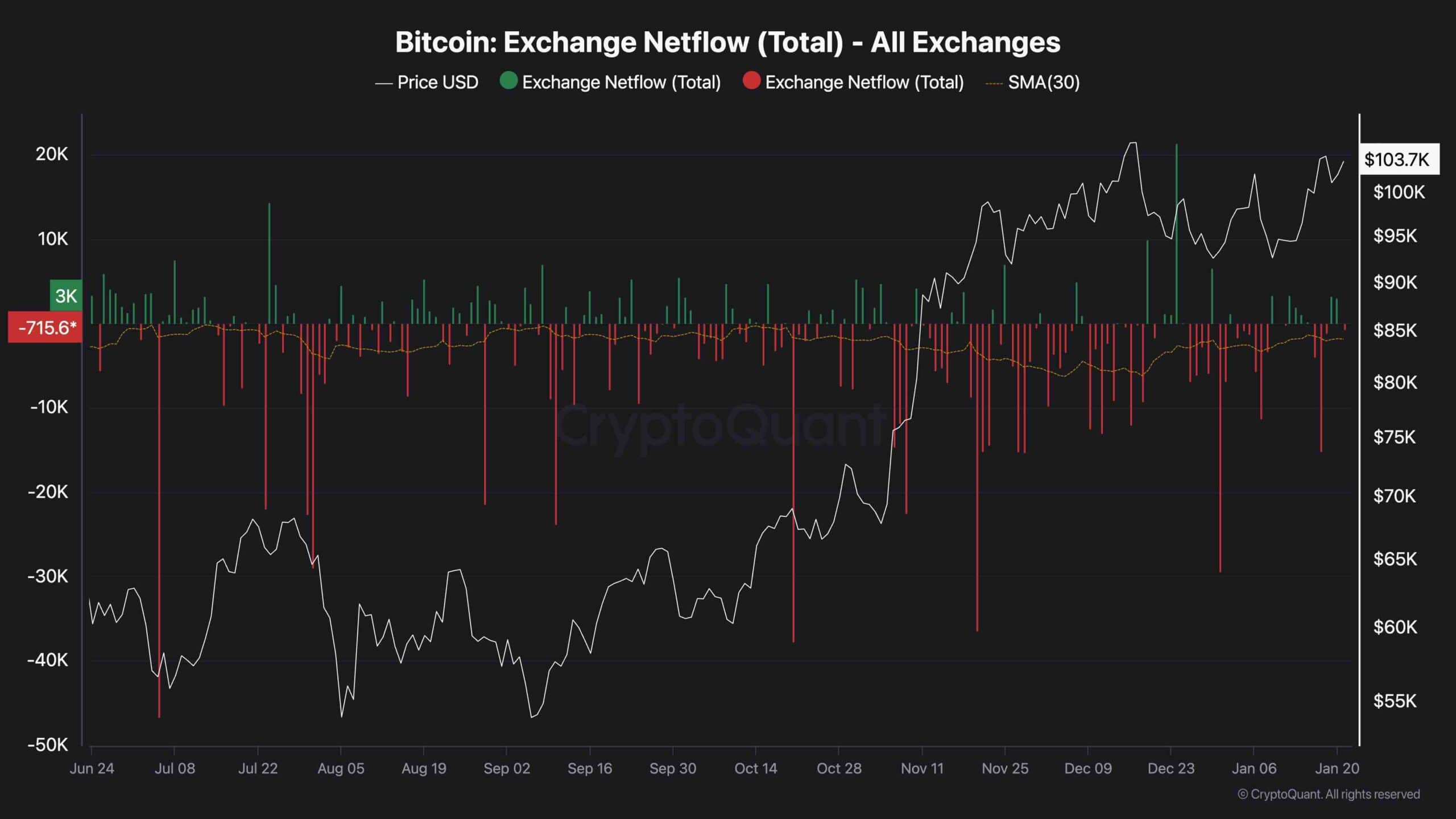

Bitcoin Change Netflow

With Bitcoin making a brand new file peak yesterday, traders at the moment are extra optimistic than ever and expect a rally larger within the coming weeks. These expectations could be clearly witnessed by trying on the Bitcoin change netflow metric.

This metric measures the web quantity of BTC deposited to or withdrawn from exchanges. Optimistic web flows point out mixture deposits, whereas adverse inflows present mixture withdrawals.

Because the chart suggests, the 30-day shifting common of the Bitcoin netflow metric has been displaying adverse values for months now. This means accumulation by market contributors, which exhibits their bullish expectations and can even result in these anticipations turning into the reality by making a provide shock. Subsequently, if issues stay the identical, larger costs are seemingly for BTC within the coming weeks.