Ethereum is making an attempt a restoration after bouncing from the $1,800 zone, however the value stays trapped under key resistance, and the broader development remains to be bearish. Brief-term momentum has improved barely, however upside continuation stays unsure.

Technical Evaluation

By Edris Derakhshi

The Day by day Chart

The every day chart exhibits ETH stabilizing across the $1,900 space following a pointy rejection from the $2,200 zone in late March. The asset stays nicely under the 200-day transferring common, which continues to slope downward across the $2,800 area, confirming bearish market construction on a macro stage.

The latest bounce has taken the worth again into the $1,900 resistance zone, however the consumers are but to indicate sturdy follow-through. The RSI can also be rebounding from oversold ranges, suggesting short-term reduction, however there isn’t any bullish divergence or momentum breakout to assist a sustainable development reversal. A decisive every day shut above $1,950–$2,000 could be the primary sign that consumers are regaining management.

The 4-Hour Chart

On the 4-hour timeframe, ETH is buying and selling inside a horizontal consolidation sample, with the decrease boundary at $1,800 and the upper one close to the $2,200 area. After the current sell-off, the worth rebounded into the $1,900 provide zone however confronted speedy resistance and is now pulling again barely.

Furthermore, RSI hit near-overbought situations throughout the bounce and is now cooling off, indicating potential consolidation or one other retest of the $1,800 space. If ETH fails to interrupt out above the upper boundary of the sample, one other leg down to brush the $1,780–$1,750 liquidity turns into extra possible. A confirmed breakout above $2,200, nonetheless, would invalidate the sample and counsel a short-term bullish reversal.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

Trade Reserve

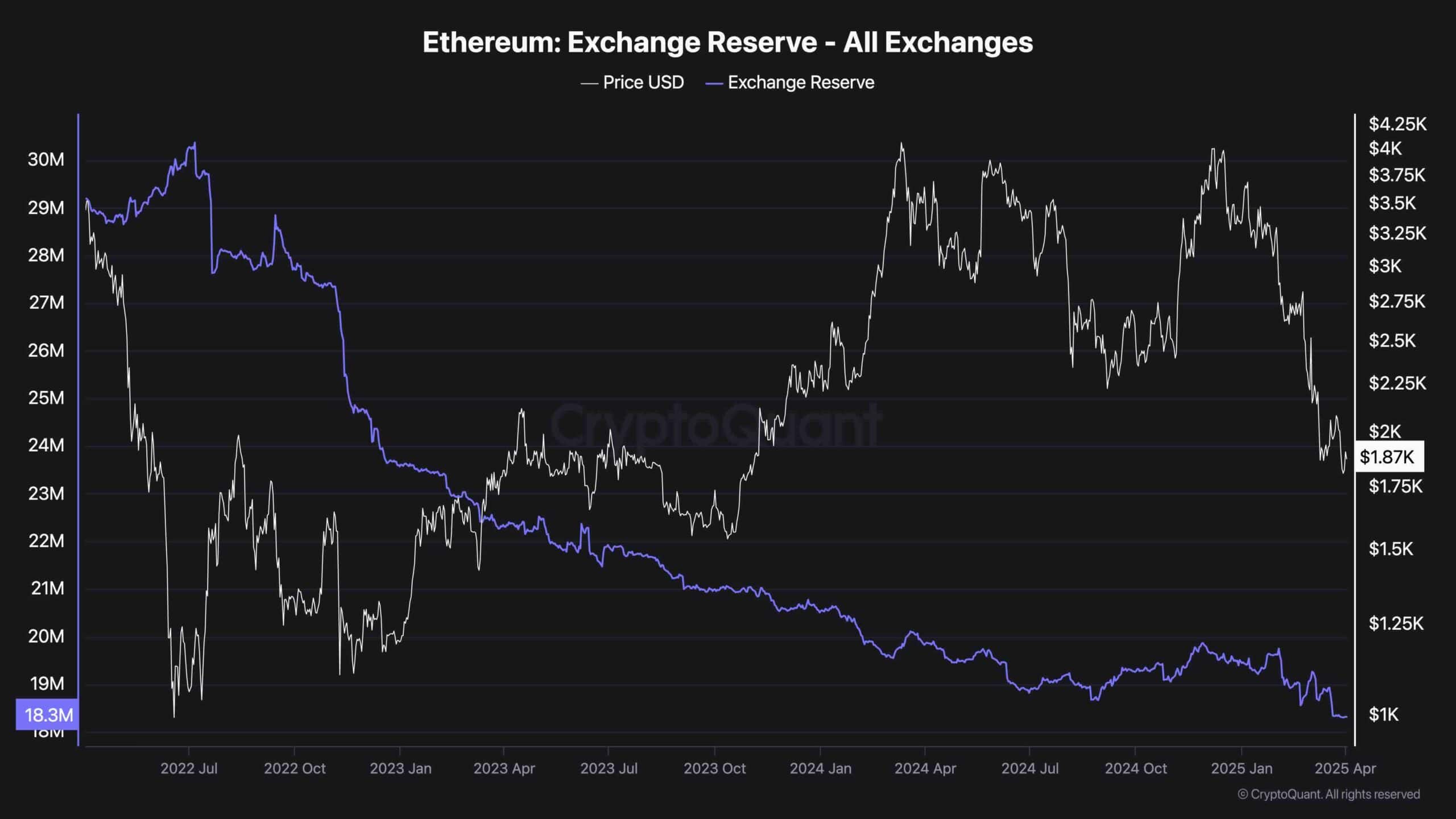

Ethereum’s alternate reserve has continued its multi-month downtrend, now reaching a brand new low of round 18.3M ETH held on buying and selling platforms. This persistent decline suggests long-term holders and establishments are transferring property into chilly storage or staking, decreasing speedy promote strain.

Regardless of the bearish value motion, the provision on exchanges is just not growing, which traditionally has acted as a bullish divergence when accompanied by reversal constructions. The low reserves could act as a provide constraint as soon as demand re-emerges, however for now, the shortage of bullish momentum means this on-chain development is supportive, not decisive.