As of Thursday, March 6, 2025, the Bitcoin (BTC) worth stays at $91,264, marking a 6% rebound from its February 27 low of $83,000. This resurgence comes amid easing commerce tensions and renewed institutional confidence, although analysts stay divided on whether or not this alerts sustainable development or a short lived reprieve.

Let’s verify why Bitcoin worth goes up right this moment, what are the present Bitcoin predictions for 2025 and why two hammer patterns on the BTC each day chart is perhaps a superb cause to consider shopping for the oldest cryptocurrency.

Bitcoin costs are rising for the third consecutive session right this moment (Thursday), returning to the consolidation vary that has been forming since November. Throughout Wednesday’s session, Bitcoin gained almost 4%, and it’s at the moment up 0.75%, buying and selling slightly below $91,300. Nevertheless, the intraday excessive was set at $92,790.

Bitcoin worth right this moment. Supply: CoinMarketCap

The constructive momentum within the Bitcoin market can be driving positive factors in altcoins. Ethereum (ETH) and XRP are up by roughly 4%, whereas Solana (SOL) and Dogecoin (DOGE) have gained over 5%.

Present Bitcoin Market Dynamics: March 6 Snapshot:

- Worth: $91,264 (24-hour excessive: $91,612)

- Market Cap: $1.81 trillion (+5.9% weekly)

- Quantity: $50.82 billion (-17% from February peak)

- Worry & Greed Index: 25 (Excessive Worry)

- DeFi: Complete Worth Locked (TVL) rebounds 12% to $98B

- Mining: Hashprice recovers to $0.098/TH/day (+18% weekly)

Will Bitcoin Go Up? BTC/USDT Technical Evaluation

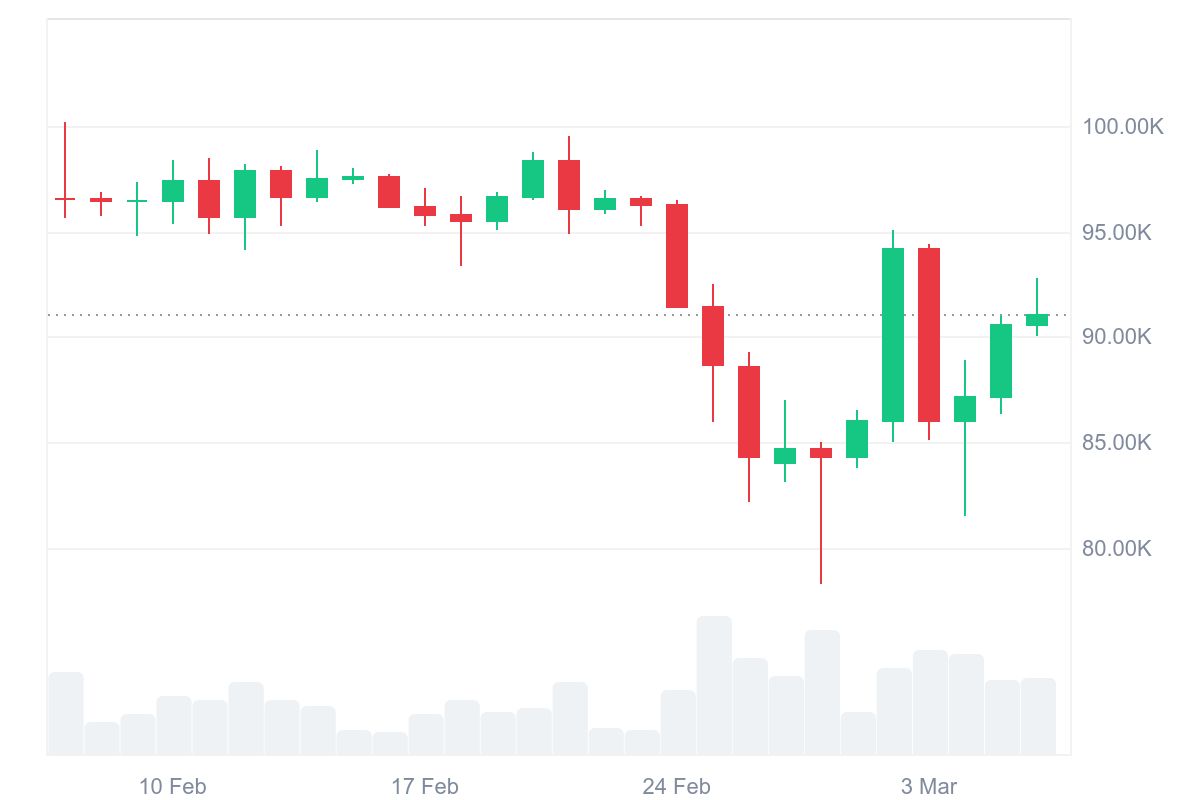

In my earlier Bitcoin technical analyses, I highlighted key purchase alerts that emerged between late February and early March. Twice, these alerts took the type of pin bars (hammer patterns):

- The primary appeared on February 28, when Bitcoin briefly dipped beneath the psychological help degree of $80,000.

- The second fashioned on March 4, as the worth tried to drop beneath the 200 EMA.

Each of those single-candle formations indicated sturdy rejection of decrease ranges and vital accumulation by consumers across the November lows. Consequently, BTC has been rising for the third consecutive session, returning to the consolidation vary noticed over the previous 4 months.

We noticed an analogous state of affairs additionally on XRP each day chart. You possibly can verify extra right here: Will XRP Go Up? New Worth Forecasts Present If XRP Can Attain $100

Presently, Bitcoin is “caught” on the decrease boundary of this vary, between $90,000 and $92,000, a degree outlined by the lows from November to January. Moreover, it faces resistance from the 50 EMA, situated round $94,400. Nevertheless, the technical outlook is much better than it was a month in the past, and for my part, we’re progressively heading towards the $108,000–$109,000 vary, with a possible 20% upside.

Bitcoin technical evaluation. BTC/USDT. Supply: Tradingview.com

At this level, I wouldn’t enter lengthy positions but. As an alternative, I’d wait for an additional affirmation sign—both across the present worth zone or above the 50 EMA.

What Occurred to Bitcoin?

The February Droop: Anatomy of a 20% Correction

Bitcoin’s decline from its January peak of $109,350 to $83,000 between February 21-27 erased almost $300 billion in market capitalization. Three main components drove this correction:

1. Institutional Revenue-Taking and ETF Outflows

The approval of spot Bitcoin ETFs in January 2024 initially propelled costs to file highs, however February noticed $20 billion movement out of those devices as establishments locked in positive factors. Avinash Shekhar, CEO of Pi42, famous that over 79,000 BTC have been offered at a loss inside 24 hours through the correction’s peak, signaling panic amongst leveraged merchants.

2. Geopolitical Tensions and Greenback Energy

Former President Donald Trump’s risk of 25% tariffs on EU imports triggered risk-off sentiment throughout world markets. The U.S. greenback index (DXY) strengthened to 105.4 throughout this era, pressuring Bitcoin’s dollar-denominated valuation. Ryan Lee of Bitget Analysis noticed that Bitcoin’s correlation with tech shares hit 0.87 through the sell-off, its highest since 2020.

3. Technical Breakdowns and Liquidation Cascades

The breach of the $85,000 help degree on February 25 triggered $1.2 billion in derivatives liquidations. Glassnode knowledge revealed Bitcoin’s 30-day realized volatility spiked to 82%, exceeding ranges seen through the 2020 COVID crash. The Common Directional Index (ADX) plunged from 27.6 to 17.5, indicating pattern exhaustion.

The March Rebound: Catalysts Behind the ten% Restoration

Bitcoin’s resurgence to $91,264 by March 6 stems from 4 converging drivers:

1. Tariff Aid and Greenback Weak spot

Trump’s resolution to delay auto tariffs on Canada and Mexico till April 2025 eased commerce warfare fears, weakening the DXY to 103.77. This boosted demand for inflation-hedge belongings, with Bitcoin’s 30-day correlation to gold turning constructive (+0.34) for the primary time since 2022.

2. Institutional Accumulation Indicators

MicroStrategy added $43.9 million price of BTC on March 5, increasing its holdings to 205,000 BTC. Concurrently, Coinbase reported a 40% surge in institutional OTC trades above $1 million, suggesting renewed accumulation.

3. Technical Re-Entry Patterns

The Directional Motion Index (DMI) flipped bullish on March 4, with +DI rising from 17.7 to 27.9 and -DI dropping to twenty.56. Bitcoin’s break above the Ichimoku Cloud’s Senkou Span A ($88,200) confirmed a bullish pattern reversal.

4. Regulatory Tailwinds

The White Home Crypto Summit announcement on March 5 fueled hypothesis about potential U.S. Bitcoin reserve insurance policies. Analysts at Constancy Digital Belongings estimate that 1% of Treasury reserves allotted to BTC may add $80 billion in shopping for strain.

Bitcoin Worth Forecasts: Diverging Views for 2025

Bull Case: $180,000–$250,000

- Fundstrat (Tom Lee): $250,000 goal primarily based on halving-induced provide shock and potential U.S. Treasury adoption. Lee notes that if the U.S. allotted 0.5% of reserves to BTC, it might take in 85% of annual provide.

- Customary Chartered: $200,000 projection citing ETF inflows reaching $100 billion by This autumn.

- VanEck (Matthew Sigel): $180,000 estimate predicated on Bitcoin capturing 10% of the $12 trillion offshore wealth market.

Base Case: $120,000–$150,000

- JPMorgan: $145,000 forecast assuming 3x development in Lightning Community capability to eight,000 BTC.

- Bloomberg Intelligence: $135,000 mannequin primarily based on Bitcoin reaching 20% of gold’s market cap.

Bear Case: $70,000–$85,000

- BitMEX (Arthur Hayes): $70,000 warning if ETF outflows exceed $30 billion.

- Glassnode: $74,000 help degree tied to realized worth of long-term holders.

Bitcoin’s 2025 worth motion displays its maturation right into a macro asset class, with 30-day volatility now similar to Nasdaq (-18% vs -24% in February)9. Whereas short-term fluctuations persist, the convergence of institutional adoption, regulatory readability, and macroeconomic instability creates a bullish structural backdrop.

Bicoin Information, FAQ

Why Is Bitcoin Going Up Now?

Bitcoin has been rising for 3 consecutive periods, at the moment buying and selling round $91,264 after rebounding from its late February low of $83,000. This worth restoration is pushed by a mixture of easing commerce tensions, renewed institutional shopping for, and technical indicators signaling accumulation. Particularly, former President Donald Trump’s resolution to delay auto tariffs on Canada and Mexico has softened commerce warfare considerations, resulting in a weaker U.S. greenback.

What If I Purchased $1 of Bitcoin 10 Years In the past?

When you had bought $1 price of Bitcoin in March 2015, when Bitcoin was buying and selling round $250, you’ll have acquired roughly 0.004 BTC. At right this moment’s worth of $91,264, that small funding would now be price about $365—a rise of over 36,000%. This development displays Bitcoin’s evolution from a distinct segment digital asset to a globally acknowledged retailer of worth.

Is Bitcoin Anticipated to Rise?

Forecasts from establishments like Fundstrat and Customary Chartered predict Bitcoin may attain between $180,000 and $250,000 in 2025.

Can Bitcoin Attain $200,000 in 2025?

Sure, Bitcoin reaching $200,000 in 2025 is inside the realm of chance, however it might require a mixture of sturdy institutional demand, favorable macroeconomic situations, and continued adoption. Whereas $200,000 is feasible, a extra conservative base-case forecast locations Bitcoin between $120,000 and $150,000 by the top of 2025.