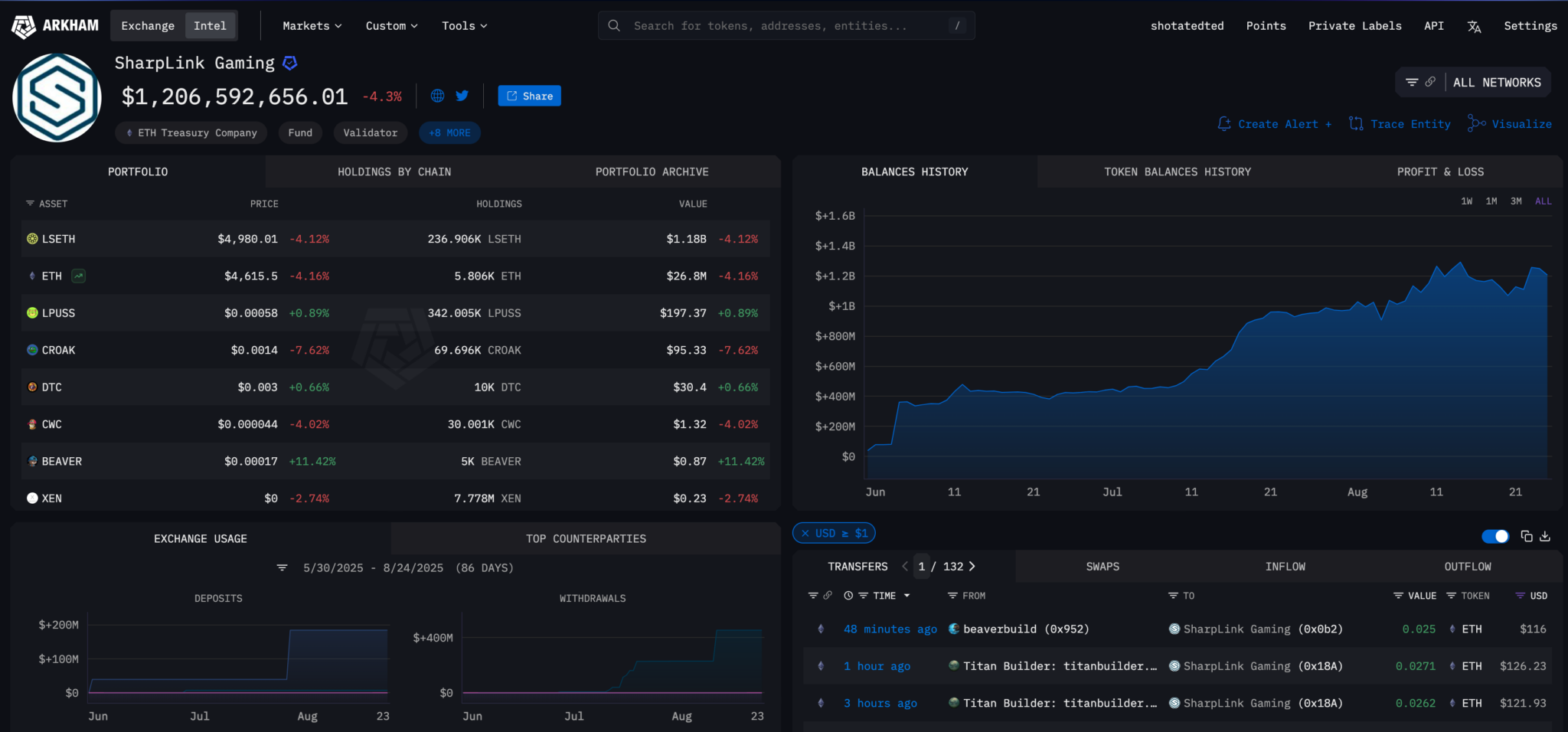

SharpLink has turn out to be some of the aggressive Ethereum treasury firms of 2025. In Could, it raised $425 million in a personal placement led by Consensys, and in July, it appointed former BlackRock government Joseph Chalom as co-CEO. By August 24, SharpLink disclosed holdings of 797,704 ETH and greater than 1,799 ETH in staking rewards.

BeInCrypto sat down with Chalom to debate why SharpLink guess on Ethereum, the way it plans to outlive risky cycles, and what its enlargement into Asia means for traders at a time when rivals like Bitmine already maintain 1.7M ETH.

Why Ethereum, Not Bitcoin or Stablecoins

The interview opened with the apparent query: Why Ethereum as an alternative of Bitcoin or stablecoins? Chalom mentioned SharpLink’s mission was to transcend being one other company holder and to deal with Ethereum as infrastructure.

“Ethereum is turning into Wall Avenue’s invisible spine.” – @ethereumJoseph

Joseph said this throughout SharpLink Gaming’s Q2 earnings name!!

BULLISH

pic.twitter.com/Li8elXUkyz

— Crypto Banter (@crypto_banter) August 24, 2025

“We’re positioning SharpLink to basically be the definitive institutional gateway to Ether publicity, Ether being the token that secures the Ethereum community. Our objective is to turn out to be the world’s most trusted Ethereum treasury firm and the main institutional advocate for Ethereum as a platform.”

Chalom then contrasted Ethereum’s programmability with Bitcoin’s narrower focus. He mentioned Bitcoin had been improbable as a digital retailer of worth and its community as a layer shifting that worth forwards and backwards. This as an alternative emphasizes why Ethereum is his long-term guess.

“Ethereum permits for a lot of, many several types of purposes to be constructed on it. We’re of the view that proper now we’re at a second that issues. There’s a long-term Ethereum alternative, not an Ethereum commerce. The normal monetary system is lengthy overdue for an improve, and we strongly consider that Ethereum will likely be that future platform of economic curiosity.”

Transparency and ETH Per Share

From the start, SharpLink has highlighted transparency. The corporate publishes weekly updates that checklist capital raised, ETH bought, common buy value, and ETH per share.

“We intention to accumulate and accumulate as a lot ETH as potential for our stockholders on the lowest entry level. And we’re fully dedicated to transparency. Each week, we publish how a lot capital was raised, how a lot ETH we bought, at what value, and ETH per share. That final one — ETH per share — is the primary metric we wish traders to observe.”

As of August 24, the agency reported 797,704 ETH in its treasury and 1,799 ETH in cumulative staking rewards. This cadence lets traders monitor accretion in actual time.

Staking, DeFi, and Danger Administration

Now that they’ve accrued ETH, they are going to profit from staking. By late August, SharpLink had earned practically 1,800 ETH in rewards. Chalom described how the corporate makes use of Ethereum’s staking design.

“ETH is exclusive relative to Bitcoin as a result of it will possibly generate yield by means of staking, which turns into income. We at the moment use native staking by means of custodians and liquid staking tokens. Future plans embrace native staking, restaking, and leveraging DeFi yield, aiming to construct a diversified portfolio of staking yield alongside an environment friendly frontier.

Native staking yields round 3%, however alternatives exist to extend this yield by means of risk-managed, institutional strategies. The primary accountability of an Ethereum treasury is to guard the principal, guaranteeing no undue dangers are taken.”

SharpLink anchors its technique with custodial staking and selectively provides higher-yield approaches solely with oversight. Companions embrace Consensys, Anchorage Digital, and Coinbase.

Management Priorities and Competitors

Chalom was appointed as SharpLink co-CEO in July after twenty years at BlackRock. He mentioned his priorities had been investor training and group constructing.

“After a 20-year profession at BlackRock, the place I used to be liable for launching impactful digital asset methods throughout stablecoins, crypto entry, and tokenization, my focus at SharpLink has been twofold. First, educating traders and the general public in regards to the long-term macro Ethereum alternative, distinguishing it from short-term trades.

Second, constructing a best-in-class group at the side of companions like Consensys and Joe Lubin to make sure a differentiated providing and high expertise within the ETH treasury business.”

SharpLink faces rivals like Bitmine Immersion Tech, which has pushed the latest Ethereum treasury technique collectively, and already holds 1,800,000 ETH. Chalom known as this wholesome competitors.

“Competitors is wholesome. We name it co-opetition. It brings vibrant minds and institutional capital into the Ethereum alternative. What units us aside is being probably the most institutional Ethereum treasury firm — best-in-class governance, disciplined capital elevating, and strategic partnerships that no different agency can replicate.”

Ethereum’s volatility led to questions on resilience. Chalom mentioned SharpLink’s mannequin is structured to endure downturns.

“Ethereum is risky, and we all know there will likely be downturns. The way in which we survive is by conserving bills lean, avoiding leverage, and being completely clear. ETH per share is the important thing quantity. Buyers can see precisely whether or not we’re creating worth. That’s how we construct belief in good occasions and unhealthy.”

Analysts warn that treasuries reliant on debt face a $12.8 billion maturity wall by 2028. SharpLink’s equity-funded strategy and weekly reporting intention to maintain it away from pressured gross sales.

How SharpLink Differs From Spot ETH

When requested whether or not SharpLink’s shares, if tokenized and traded alongside spot ETH, can be seen as a proxy for Ethereum or as competitors, Chalom mentioned SharpLink shares would complement ETH, not compete with it.

“SharpLink is an entry car for ETH, wrapped in a public firm construction that provides accumulation, capital appreciation, and staking advantages. If our fairness had been tokenized, it will merely prolong that mannequin right into a 24/7 market surroundings.”

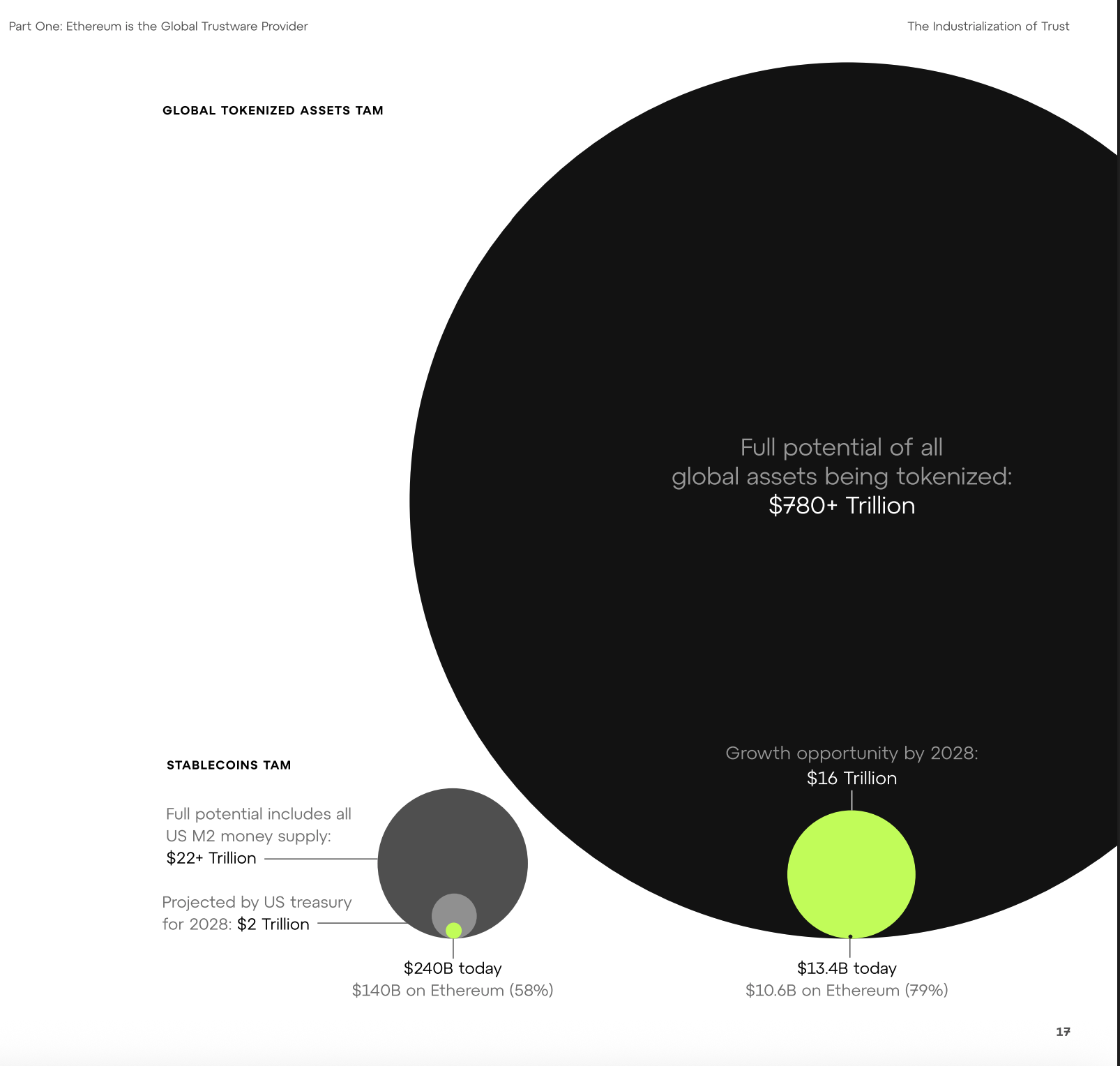

He added that the larger development is tokenization of all property, with Ethereum because the settlement layer.

“However what’s coming is far bigger. Tokenized funds, tokenized equities, tokenized ETFs — that’s the subsequent wave. The digitization of finance will occur on Ethereum.”

Chalom mentioned the tokenization development will drive Ethereum’s long-term worth. He positioned SharpLink as an entry car for ETH and a approach for traders to seize the broader transformation.

RWA Market Prediction | Consensys

“SharpLink is an entry car for ETH, wrapped in a public firm construction that provides accumulation, capital appreciation, and staking advantages. However what’s coming is far bigger. Tokenized funds, tokenized equities, tokenized ETFs — that’s the subsequent wave.

World markets are $100 trillion. Crypto as we speak is $4 or $5 trillion. The digitization of finance will occur on Ethereum. Belongings will commerce 24/7, settle immediately, and be programmable. Tokenization is not only a crypto story. It’s the way forward for finance.”

He defined that because of this SharpLink holds ETH completely, not layer-2 tokens. Ether secures the stack and affords clear publicity for institutional traders.

APAC Enlargement and Investor Training

SharpLink will set up a presence in Asia, particularly Korea, Japan, and Singapore, and it plans to attend Korea Blockchain Week and Token2049 Singapore. Chalom mentioned the area has been retail-heavy however is shifting towards establishments as rules mature.

“Asia has all the time been extra retail-driven than the US or Europe. However I feel we’re in the beginning of a generational shift. Regulators are clarifying frameworks, and institutional capital is prepared. We plan to be current in Korea, Japan, and Singapore quickly, elevating capital globally and constructing a very worldwide treasury.”

BeInCrypto famous that household places of work in Asia already allocate 3%–5% of portfolios to crypto. Chalom in contrast as we speak’s surroundings to the early web period, stressing that training and transparency will likely be key to accelerating institutional flows.

ETH Worth Outlook and Closing Feedback

Requested about ETH value targets, Chalom averted particular numbers and pointed to Consensys’s Trustware mannequin as an alternative.

“It’s quite simple. What do you assume adoption and transaction quantity will likely be in crypto and tokenized funds on the Ethereum community? That’s layer ones and layer twos. Plus, what would be the real-world exercise on Ethereum? For each $2 of worth secured, it drives about $1 in market cap for ETH.

In case you consider what Secretary Bessent has mentioned in regards to the adoption of stablecoins and the tokenization of property — each largely taking place on Ethereum — then you’ll be able to calculate that the worth of the ETH token will likely be considerably greater within the quick, mid, and long run. That’s the Ethereum alternative we’re betting on. That’s the reason we predict this can be a profitable technique for the long term.”

He summarized the thesis as a macro allocation: Ethereum is just not a commerce however a programmable infrastructure for stablecoins and tokenized capital markets.

Chalom urged traders to concentrate on firms that pair transparency with institutional capabilities, arguing that these qualities will determine which treasuries will endure because the market matures.

“We consider this can be a long-term Ethereum alternative and never a commerce. In case you see this as a macro funding thesis, it’s best to have a look at probably the most trusted and most clear Ethereum treasury firms. That’s the reason we differentiate SharpLink and why we’re constructing for the long term.”

With that, Chalom underscored SharpLink’s ambition to turn out to be the benchmark Ethereum treasury firm: clear, institutional, and constructed to endure cycles whereas betting on tokenization and stablecoin adoption because the anchors of Ether’s long-term worth.