Ethereum has damaged previous the $2,000 mark, setting $2,490 as its subsequent resistance degree. After months of weak sentiment and heavy promoting stress, Ethereum is taking again misplaced floor. The rally brings again optimism, significantly with the retracing of Bitcoin round its all-time excessive. Nonetheless, merchants at the moment are involved about whether or not it might maintain this upward momentum.

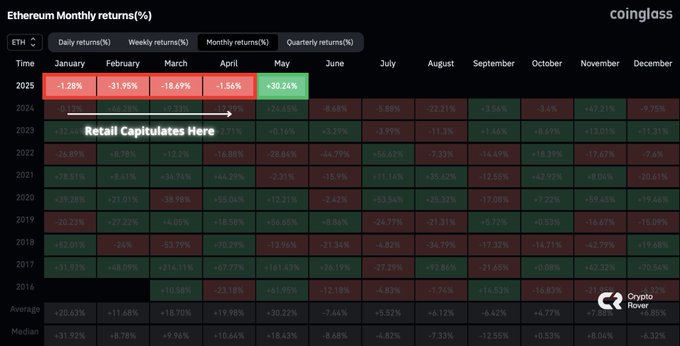

Analyst Crypto Rover reported that almost all of Ethereum holders have capitulated. He congratulated these nonetheless holding, implying that important beneficial properties had been on the horizon. His phrases point out growing confidence in Ethereum’s functionality to proceed the present bullish pattern. He additionally included a chart presenting Ethereum’s month-to-month efficiency, with Might 2025 attaining a formidable 30.24%. This follows a downturn within the earlier months, strengthening the notion that Ethereum is on the rise.

Supply: X

Ethereum Alerts Bullish Momentum

The current worth motion of Ethereum relative to Bitcoin reinforces the rising optimistic market sentiment. On each the one-hour and four-hour charts, the ETH/BTC pair has proven bullish momentum, with the value shifting above key shifting averages. Ethereum’s sturdy efficiency in comparison with Bitcoin suggests a shift in market dynamics.

Ethereum has already surpassed the 0.02 degree on the 50-day easy shifting common (SMA) on the day by day ETH/BTC chart, holding that place for over two days, an indication of a possible bullish pattern. It has additionally damaged the 200-day SMA, including to the optimistic outlook. Now, monitoring is important to find out if Ethereum can preserve its momentum over these essential ranges.

With Ethereum now consolidating above $2,000, many buyers are optimistic about its outlook. Regardless of this optimistic sentiment, market situations stay risky, and merchants ought to stay cautious of potential pattern reversals. The subsequent a number of weeks might reveal whether or not this rally indicators the beginning of a longer-term bullish part for Ethereum.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t chargeable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.