Ethereum (ETH) has traded sideways for over a month, with its value remaining below the important thing $3,500 resistance stage.

Nevertheless, on-chain knowledge has proven {that a} shift could possibly be underway. This evaluation explains the 2 key components suggesting a possible breakout could be imminent.

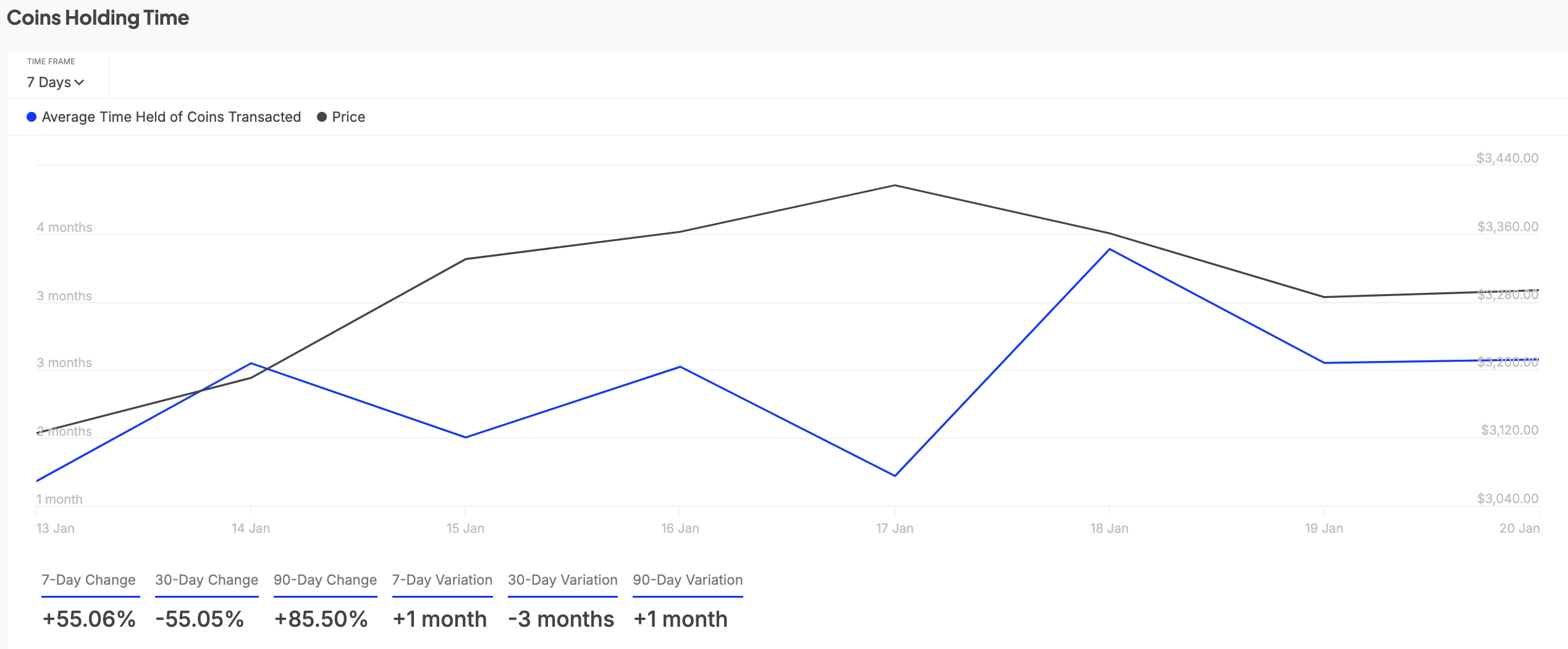

Ethereum Sees Surge in Holding Time

On-chain knowledge has revealed a spike within the holding time of all ETH cash transacted over the previous seven days. In keeping with IntoTheBlock, this has elevated by 55% through the assessment interval.

The holding time of an asset’s transacted cash represents the typical length tokens are held earlier than being bought or transferred. Lengthy holding intervals replicate stronger investor conviction, as traders select to maintain their cash relatively than promote. This will help cut back the promoting stress within the ETH market, driving up its worth.

ETH Cash Holding Occasions. Supply: IntoTheBlock

Additional, ETH’s funding charge has remained optimistic regardless of its range-bound value actions in current weeks. At press time, it’s 0.019%, reflecting the regular demand for lengthy positions amongst ETH’s futures merchants.

The funding charge is a charge exchanged between lengthy and brief merchants on perpetual futures contracts to maintain the contract’s value in step with the underlying asset’s spot value.

ETH Funding Price. Supply: Santiment

Regardless of its sideways motion, ETH’s regular optimistic funding charge signifies that extra merchants are betting on its value going up, signaling bullish sentiment.

ETH Worth Prediction: Break $3,516 for a Climb to $3,684, or Threat Pullback?

Waning selloffs may propel ETH above the resistance shaped at $3,516. If it efficiently breaks above this key resistance stage, its value may climb towards $3,684.

ETH Worth Evaluation. Supply: TradingView

Nevertheless, if this bullish pattern stalls, the coin may fall again throughout the slim vary or drop towards assist at $3,210.