Ethereum has amassed $425 million in capital from SharpLink Gaming’s treasury allocation. The most important altcoin has attracted massive volumes of institutional capital inflows to ETFs previously week. Whales and establishments have tried to reinstate confidence amongst merchants, nevertheless the method has confirmed painfully sluggish.

We dive deeper and discover out why merchants are usually not shopping for Ethereum’s (ETH) new narrative and what it’ll take for ETH to interrupt out of the consolidation and hit a brand new all-time excessive this cycle.

Desk of Contents

Ethereum ETF flows and whale accumulation

Ethereum Spot ETFs have attracted constantly massive inflows from institutional buyers within the final 4 weeks. Knowledge from crypto intelligence tracker SoSoValue exhibits that the day by day whole netflow to Ethereum ETFs exceeds $11 million.

Ethereum ETFs recorded a big spike on June 11 with a day by day web influx that exceeds $240 million. This week the inflows have been comparatively under common, anticipated to select up within the latter half, amidst latest bullish developments.

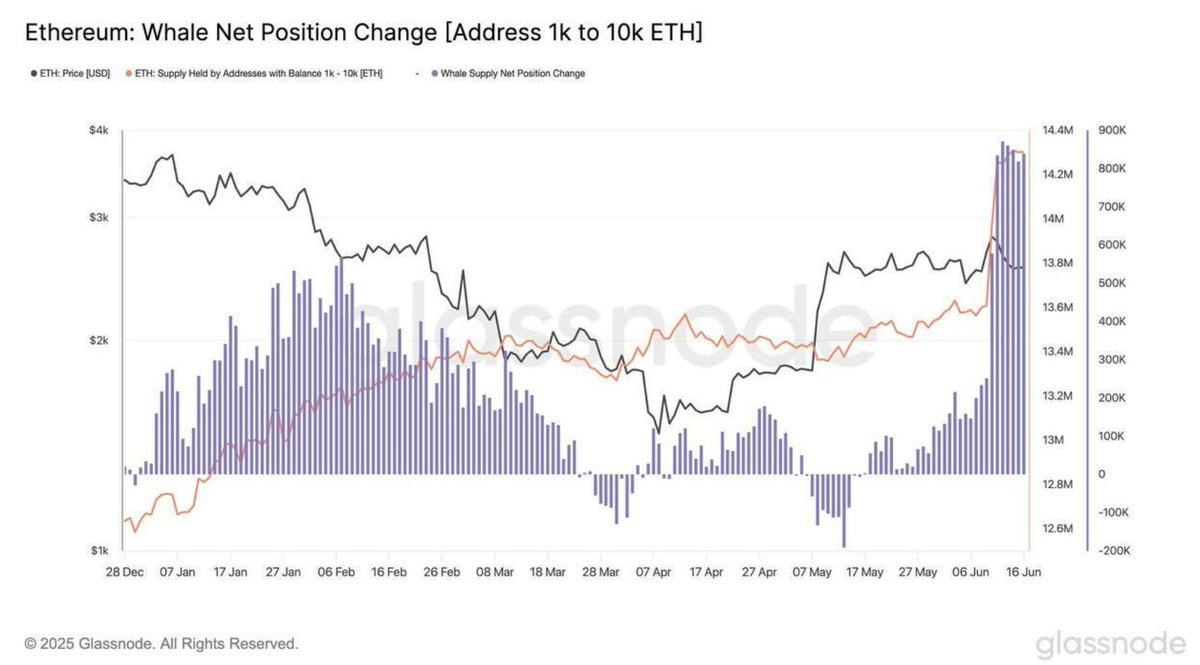

Knowledge from crypto intelligence tracker Glassnode exhibits that the day by day whale accumulation has exceeded 800,000 Ether. The Ethereum holdings of whales that personal 1,000 to 10,000 Ether have exceeded 14.3 million Ether, as of June 16. June 12 alone recorded the very best day by day web influx, the place massive pockets buyers added over 871,000 Ether.

Ethereum whale web place change for addresses holding between 1K and 10K ETH | Supply: Glassnode

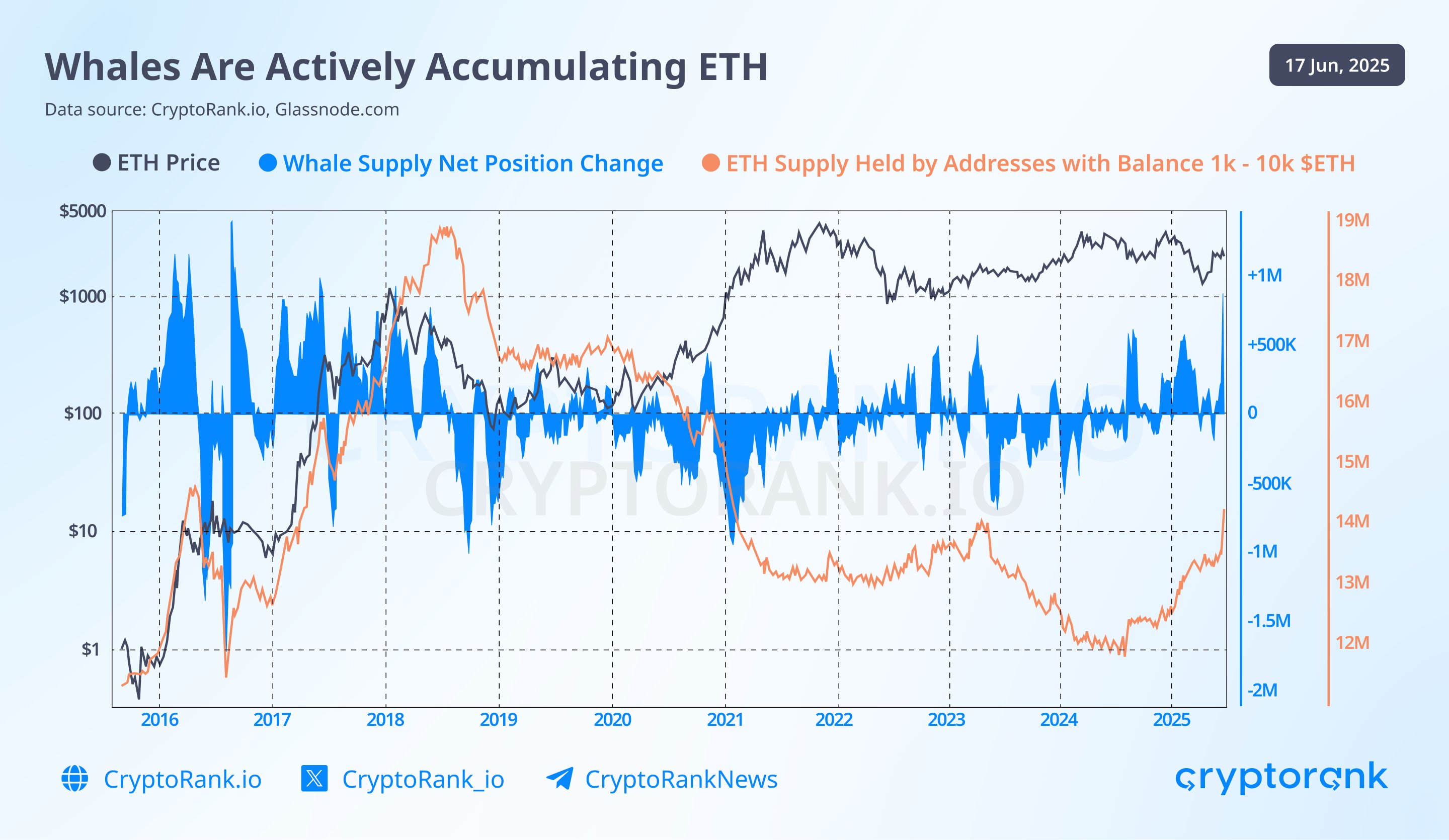

Crypto analysts at Cryptorank noticed that the size of whale accumulation seen on this cycle is uncommon and has not been seen for the reason that starting of the bull run in 2017. Beginning H2 2024, whales have been accumulating ETH, with the development rising sharply within the final 4 weeks, supporting a bullish thesis for Ether.

Whale accumulation of Ethereum | Supply: Cryptorank

You may also like: Ethereum value outlook: $3,200 or $1,587 as 39-day vary nears breakout

In Ethereum they trust- Trump Media’s twin Bitcoin and Ethereum ETF submitting

Trump Media and Know-how Group (DJT), an American know-how big headquartered in Florida boasts US President Donald Trump as a majority proprietor. The corporate filed for a twin Bitcoin and Ethereum ETF on June 16, with a 75% allocation to BTC and 25% to ETH.

In its SEC submitting, Trump Media listed Crypto.com as its custodian and liquidity supplier, pending regulatory approval. If the US monetary regulator approves the product, it might be the primary dual-spot crypto ETF backed by the President of the USA.

Specialists imagine Ethereum’s inclusion within the twin ETF is just not a mere coincidence, quite a present of confidence amidst the rising institutional curiosity in Ether. World Liberty Monetary, one other entity backed by the Trump household, has slowly lowered its publicity to Ether since its launch, elevating issues whether or not the Ethereum allocation is a gesture at finest; there is no such thing as a information on the non-public crypto holdings of Trump members of the family.

Why merchants aren’t shopping for the brand new Ethereum narrative

The Trumps confirmed their assist for Ethereum, ETH acquired a $425 million capital allocation, however market individuals stay largely unmoved. It virtually looks as if merchants aren’t shopping for the brand new Ethereum narrative.

SharpLink purchased 176,000 Ether for $425 million, and allotted the altcoin to their treasury. Whereas the agency grew to become the biggest company holder of Ether, it ushered in a steep decline in its inventory value.

SharpLink Gaming inventory efficiency | Supply: Yahoo Finance

SharpLink Gaming’s submitting probably confused shareholders and led to the correction. Irrespective, there’s a insecurity amongst market individuals, and neither Ethereum’s value nor SBET has recovered for the reason that announcement.

Joe Lubin and executives from Consensys have tried to publicly reassure stockholders and ETH merchants; nevertheless, the inventory is down 4.47% for the reason that market opened on Wednesday.

At a time when the Ethereum Basis has labored on its narrative, modified the management, organizational objectives and Vitalik Buterin shifted focus to technical growth. To date, there is no such thing as a important impression on ETH value, and the altcoin is consolidating near key assist at $2,400.

Ethereum believers have added the SharpLink treasury’s buy as a key catalyst for Ether, alongside institutional curiosity in Ether, the modified roadmap and upcoming technical upgrades.

Proof is within the on-chain information. With no important spike in energetic addresses, staking progress or the token’s value, Ether struggles on the time of writing.

You may also like: Why are Bitcoin and crypto costs down right this moment?

Ethereum value forecast

Ethereum is buying and selling at $2,501, above key assist on the $2,373 stage on Wednesday. ETH is lower than 10% away from the higher boundary of the FVG on the day by day timeframe, at $2,743. A day by day candlestick shut above this stage might push Ether in the direction of $3,000, a psychologically essential stage for the altcoin.

Two key momentum indicators, RSI and MACD recommend additional consolidation is probably going within the short-term. RSI reads 47, slightly below the common, and MACD flashes purple histogram bars below the impartial line, that means there may be an underlying detrimental momentum within the Ether value development within the ETH/USDT day by day value chart.

ETH/USDT day by day value chart | Supply: Crypto.information

Knowledgeable commentary

Sui Chung, CEO of CF Benchmarks advised Crypto.information in a written be aware,

“Ethereum seems to be having its AWS second — quietly however decisively establishing itself because the foundational settlement layer for on-chain monetary infrastructure. We’re witnessing this transformation unfold in actual time, and up to date regulatory and market developments are accelerating the shift.

The SEC’s latest pivot on DeFi regulation is the newest in a string of optimistic developments that may act as an entry sign for establishments which have hitherto remained on the sidelines. However this isn’t nearly value.

The broader context issues. The SEC’s softer stance, the success of Circle’s IPO, and stablecoin adoption by main e-commerce platforms are coalescing into an ideal storm. Ethereum is not only a “crypto” story — it’s turning into indispensable infrastructure. t’s not about “blockchain” anymore — not within the summary. It’s about industrial-grade, programmable cash programs. And Ethereum is main the cost.”

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.