The world’s main cryptocurrency, Bitcoin (BTC), skilled vital volatility following the Federal Reserve’s (Fed’s) newest financial coverage announcement, briefly dipping under the psychological $100,000 mark earlier than staging a restoration.

The worth motion displays broader market uncertainty as traders digest the Fed’s extra conservative method to price cuts in 2025.

Bitcoin touched $98,760 in a pointy downturn that erased almost $10,000 from its latest all-time excessive (ATH). The motion coincided with a broader sell-off in threat property, as market individuals adjusted their positions following the Fed’s hawkish steerage.

The cryptocurrency market’s response mirrors the advanced interaction between financial coverage and digital asset valuations. Whereas the Fed delivered its third consecutive price minimize, the central financial institution’s cautious stance on future reductions triggered a reassessment of threat positions throughout a number of asset courses.

“In help of its objectives, the Committee determined to decrease the goal vary for the federal funds price by 1/4 proportion level to 4-1/4 to 4-1/2 %,” Fed commented within the official assertion.

In consequence, Bitcoin fell by 5.6% throughout Wednesday’s session, testing ranges under the $100,000 mark. This marked the most important single-day drop since August 5, when the value declined by 7%, hitting a low of $49,000. As we speak (Thursday, December 19, 2024), Bitcoin additionally examined ranges under the psychological help of $100,000. Nonetheless, on the time of writing, it has modestly rebounded and is buying and selling at $101,600 on Binance.

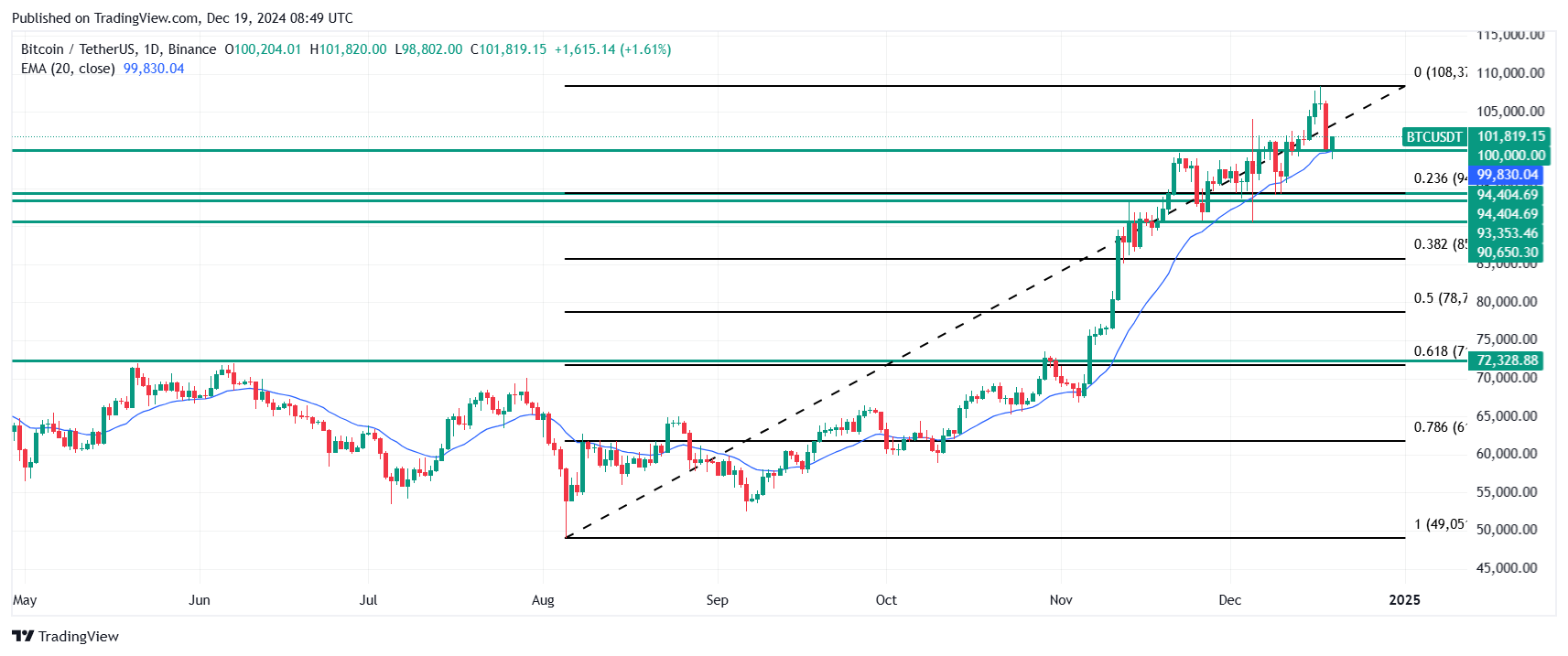

Bitcoin worth defends the $100K mark. Supply: TradingView

The cryptocurrency’s trajectory has been considerably influenced by political developments, with a 50% surge following the November presidential election. The president-elect’s pro-crypto stance and proposals for a nationwide Bitcoin reserve have basically altered market sentiment, although regulatory uncertainties persist.

Federal Reserve Chair Jerome Powell says the Fed is “not allowed to personal Bitcoin”

They weren’t allowed to personal Company Bonds earlier than Covid both.

Guidelines change… 😉 pic.twitter.com/3UBBUuKtdF

— Bitcoin Archive (@BTC_Archive) December 18, 2024

$661 Million in Longs Vanished

Over the previous 24 hours, greater than $661 million in leveraged lengthy positions have been liquidated within the cryptocurrency market, in accordance with Coinglass knowledge. The vast majority of these liquidations had been tied to Bitcoin ($110 million) and Ethereum ($109 million).

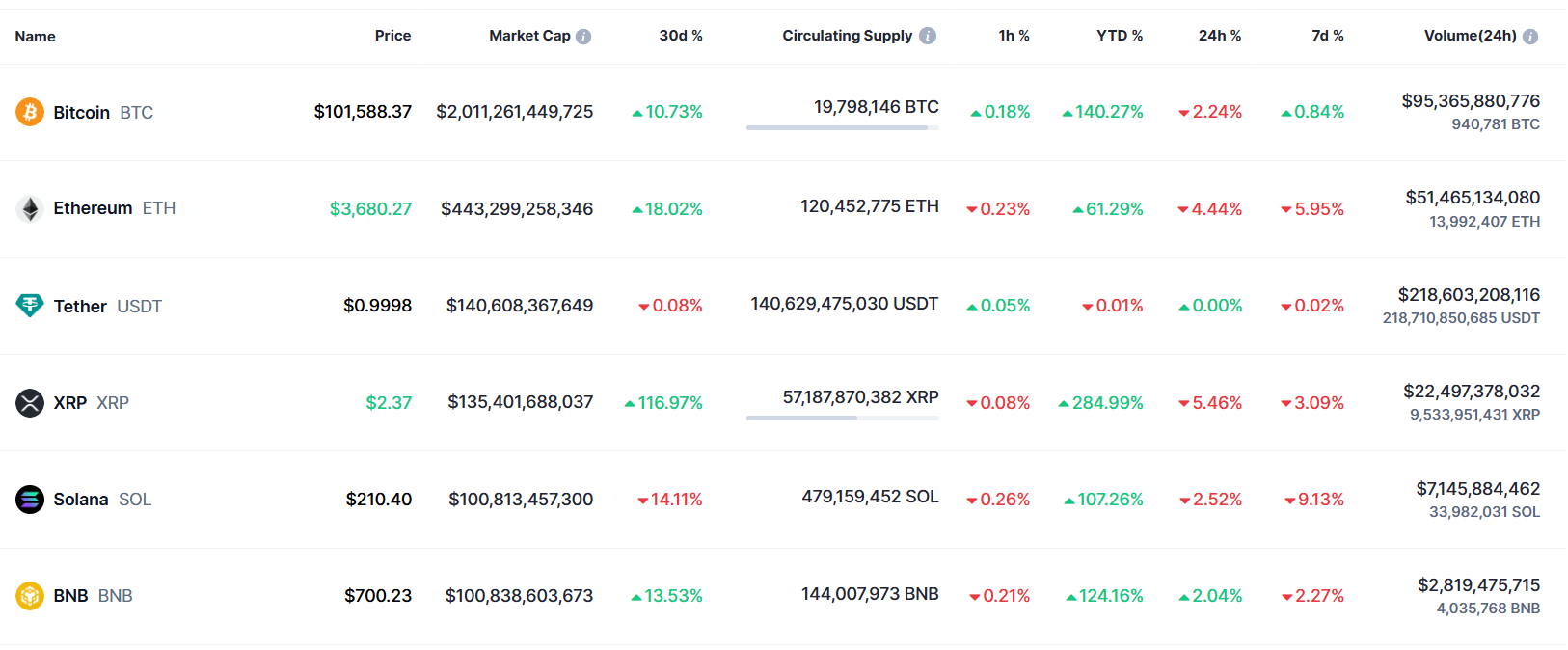

Bitcoin’s decline fueled a broader depreciation throughout the altcoin market. Alongside the oldest cryptocurrency, Ethereum additionally noticed vital losses, dropping 4.4%, together with XRP (5.4%), Solana (2.5%), and Dogecoin (5.6%).

The full market capitalization shrank to $3.7 trillion, with Bitcoin accounting for over $2 trillion of that worth.

The full market capitalization of the preferred cryptocurrencies. Supply: CoinMarketCap

Choices market exercise has proven elevated curiosity in draw back safety, with merchants searching for hedging methods amid heightened volatility. Market specialists recommend the potential for short-term worth actions towards the low $90,000 vary, although such dips are anticipated to be non permanent.

BTC Technical Evaluation: Will Bitcoin Maintain Going Down?

For my part, the $100,000 stage will function a key help ground, one which bears will discover difficult to interrupt. Moreover, Bitcoin advantages from short-term help offered by the 20-day exponential shifting common (20 EMA).

The post-Fed choice motion was vital, and with out the substantial accumulation of purchase orders close to $100K, we might probably be seeing even decrease BTC costs. I imagine this six-figure worth supplies Bitcoin with room for a rebound.

Bitcoin worth chart technical evaluation. Supply: TradingView

At this second, the essential resistance stage is the earlier all-time excessive (ATH) of almost $108,000, examined on December 15. My outlook will shift if Bitcoin drops under the present help, although that is nonetheless no motive to panic. BTC has a dense community of help ranges forward, however three key ranges stand out.

Bitcoin Worth Help Ranges

- $94,400–$94,300 – 23.6% Fibonacci retracement, bolstered by native lows.

- $90,000 – One other psychological stage and the low from December 5.

- $72,328 – 61.8% Fibonacci retracement, aligning with the Might-June highs.

Provided that Bitcoin falls under $72,000 will I alter my stance to bearish. Till then, I’ll view all downward corrections as alternatives to purchase Bitcoin at extra engaging costs.

Bitcoin Lengthy Time period Worth Prediction

VanEck’s head of digital property analysis, Matthew Sigel

Funding administration agency VanEck has unveiled its daring forecasts for the cryptocurrency market in 2025, predicting vital worth peaks adopted by a interval of market consolidation.

“Following this primary peak, we anticipate a 30% retracement in BTC, with altcoins dealing with sharper declines of as much as 60% because the market consolidates through the summer time,” VanEck’s Matthew Sigel forecasted. “Nonetheless, a restoration is probably going within the fall, with main tokens regaining momentum and reclaiming earlier all-time highs by the top of the yr.”

VanEck expects the continued crypto bull market to culminate in its first main peak throughout Q1 2025. The agency anticipates Bitcoin reaching $180,000, with Ethereum exceeding $6,000. Different notable cryptocurrencies like Solana and Sui are projected to hit $500 and $10, respectively.

Broader Bitcoin Worth Predictions for 2025

VanEck’s forecast is one in every of a number of bold projections for Bitcoin in 2025. Different distinguished predictions embrace:

These forecasts underline the various views inside the cryptocurrency trade, highlighting a mixture of macroeconomic elements and market dynamics driving optimism for Bitcoin and the broader crypto ecosystem in 2025.

For these keen on staying up to date on the newest cryptocurrency tendencies, you may discover my different analyses. Final week, I examined whether or not Dogecoin has the potential to achieve $10 and reviewed the newest developments surrounding Ripple and the XRP token’s worth actions.

FAQ, Bitcoin Worth

Why is Bitcoin dropping right now?

Bitcoin’s decline is primarily because of the Federal Reserve’s hawkish stance on future rate of interest cuts. Whereas the Fed delivered its third consecutive price minimize, they signaled fewer price reductions for 2025 than beforehand anticipated, inflicting traders to reassess their positions in speculative property.

Is Bitcoin having points?

No, Bitcoin is not experiencing technical points. The present worth motion is a market response to broader macroeconomic elements. The cryptocurrency dropped to $98,760 earlier than stabilizing above $100,000, reflecting regular market dynamics in response to financial coverage adjustments.

Is Bitcoin predicted to go up?

A number of analysts keep bullish long-term predictions for Bitcoin: VanEck forecasts $180,000 by Q1 2025, Commonplace Chartered maintains a $200,000 goal for 2025, Tim Draper tasks $250,000 by the top of 2025. The typical predicted buying and selling worth for December 2024 is round $111,724. These predictions are primarily based on elements comparable to institutional adoption and the regulatory readability.