Bitcoin is hovering round $117,826 on Wednesday as open curiosity in futures and choices markets pushes into report territory, signaling intense institutional and speculative exercise.

The Knowledge Behind Bitcoin’s Quiet Energy Shift on Derivatives Exchanges

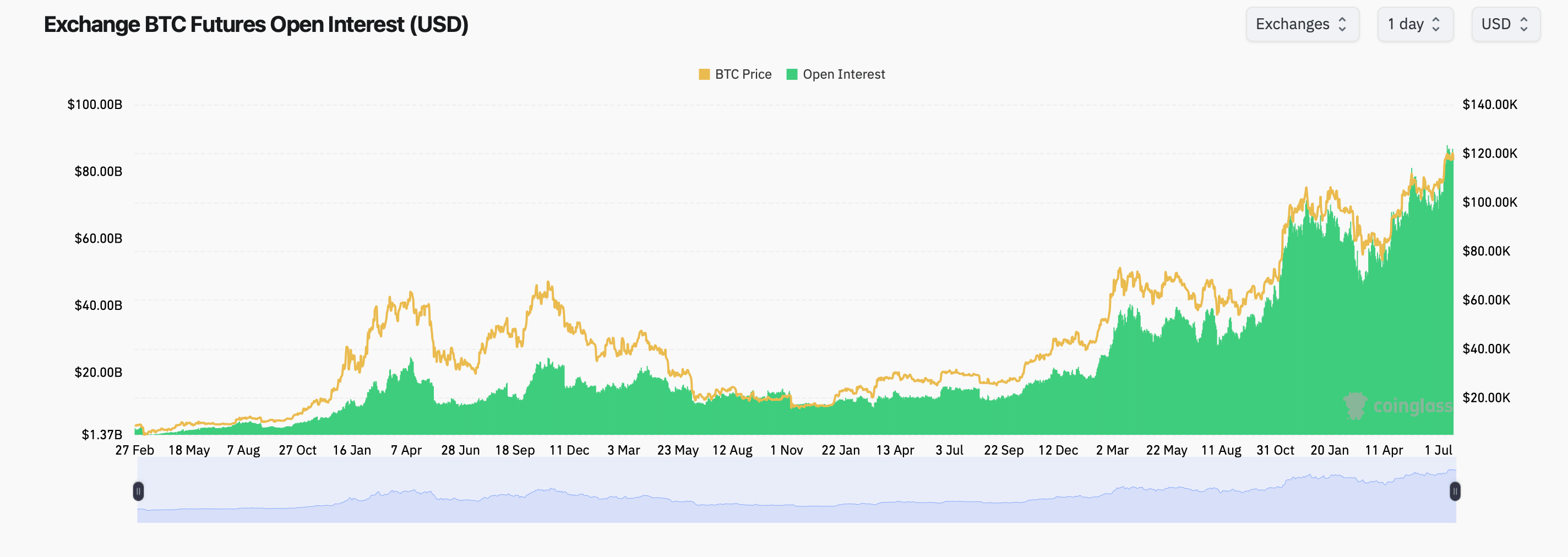

Open curiosity (OI) in bitcoin derivatives continues its climb as merchants allocate capital towards each futures and choices amid heightened market momentum. In keeping with Coinglass information, whole futures OI has reached a large $84.83 billion throughout platforms, with CME topping the checklist at $18.49 billion, adopted by Binance and Bybit.

Chart Supply: Coinglass

Bybit recorded probably the most bullish short-term exercise with a 2.06% improve in OI over the past 4 hours, whereas BingX confirmed a staggering 3.87% rise over the identical interval. Nevertheless, MEXC posted the biggest drop, falling 3.14% in 24-hour OI change. Notably, Kucoin’s 3.4% each day improve in OI suggests renewed retail hypothesis on its venue.

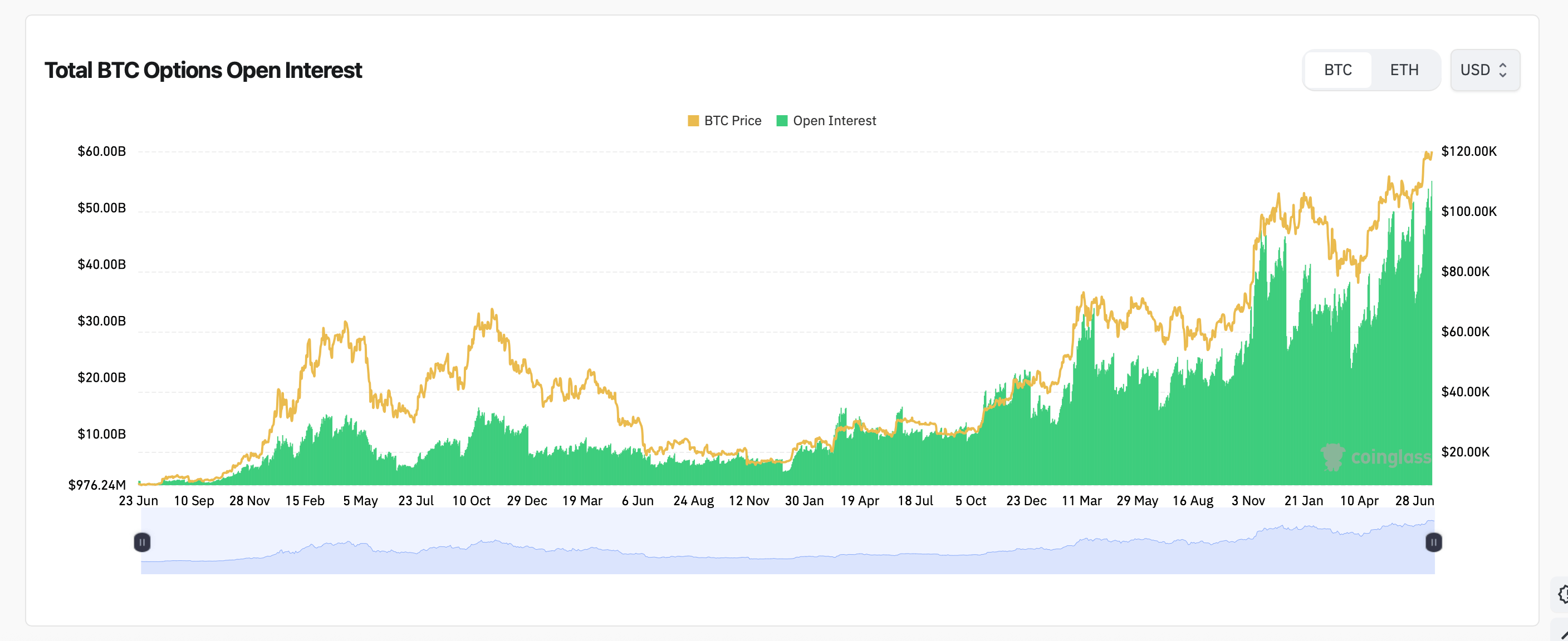

Within the choices market, Deribit stays the dominant participant. The platform’s OI rankings present merchants are closely favoring name contracts, notably these with strike costs of $120,000 to $140,000. The very best focus of OI sits with the Dec. 26, 2025, $140,000 name at 10,706 BTC, adopted carefully by a $200,000 name with 8,586 BTC.

Quantity metrics from the previous 24 hours present the July 25, 2025, $120,000 name main with 4,446 BTC traded. Places, whereas energetic, are outpaced by calls in each quantity and OI. At present, 60.76% of OI is skewed towards calls, totaling 257,518 BTC, in contrast with 166,341 BTC in places.

Choices merchants are eyeing $200K bitcoin calls as a daring, leveraged play on future features, betting on attainable boosts like exchange-traded fund (ETF) inflows and skyrocketing demand. These high-flying calls ship outsized rewards with minimal danger—However provided that bitcoin takes off like a rocket. Chart Supply: Coinglass.

This choices information paints a big bullish tilt, supported by strike focus simply above present market ranges. The July 25 expiry additionally sees intense clustering across the $115K to $120K vary, the place implied volatility (IV) ranges between 31% and 38%.

With each futures and choices displaying enlargement in capital dedication, bitcoin’s derivatives panorama continues to mirror a rising urge for food for directional bets and structured positioning at larger valuations. Merchants are clearly making ready for important worth motion in 2025’s ultimate months.