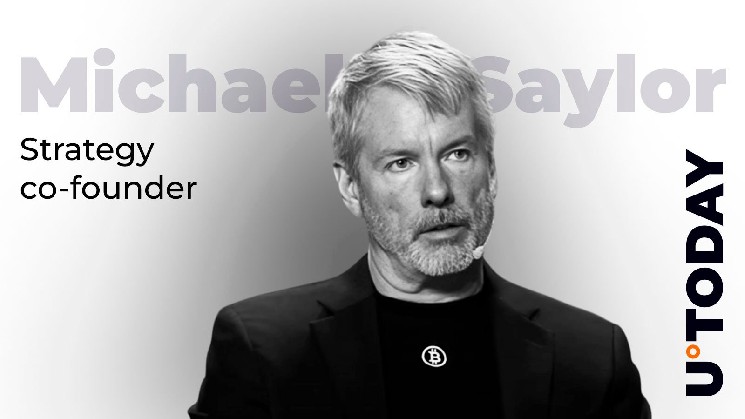

Michael Saylor, the person whose company treasury has turn out to be nearly synonymous with Bitcoin itself, is asking only one query as 2025 reaches its closing quarter: “Will BTC shut the yr above $150,000?”

His ballot has already gotten over 42,000 votes, with three out of each 4 folks saying they suppose the world’s largest cryptocurrency can attain that objective.

For Saylor, this isn’t just a few random thought. Technique, the Nasdaq-listed firm he’s answerable for, has 640,031 BTC that it purchased since August 2020 for a mean of $73,981. That stash, value over $77 billion at at present’s worth of $120,700, has the agency up by greater than 63%.

Will $BTC finish the yr above $150,000?

— Michael Saylor (@saylor) October 3, 2025

However the significance of the $150,000 mark goes past paper beneficial properties.

If Bitcoin goes as much as that zone, the worth of Technique’s holdings would improve by one other $18 billion or extra. That will carry its BTC place nearer to the $96 billion line and switch the corporate into an asset base that rivals among the world’s largest banks.

$100 billion Technique

The market is already displaying its approval. Technique’s inventory is value about $100 billion, and its enterprise worth is round $115 billion.

The Bitcoin chart additionally reveals why this query is so essential. With a market cap of simply over $120,000, BTC has climbed again up from September’s low level and is nearing its summer time highs.

The final three months of 2025 will present if Saylor’s wager turns into one of many largest company wins of the last decade or turns into the nastiest bubble burst on this century.