Coinbase, the biggest U.S.-based cryptocurrency change, is embroiled in controversies, from itemizing charges and neighborhood backlash relating to meme coin descriptions to costs from the Securities and Change Fee (SEC). The platform is now beneath intense scrutiny from trade leaders, traders, and regulators, elevating questions on its practices and regulatory compliance.

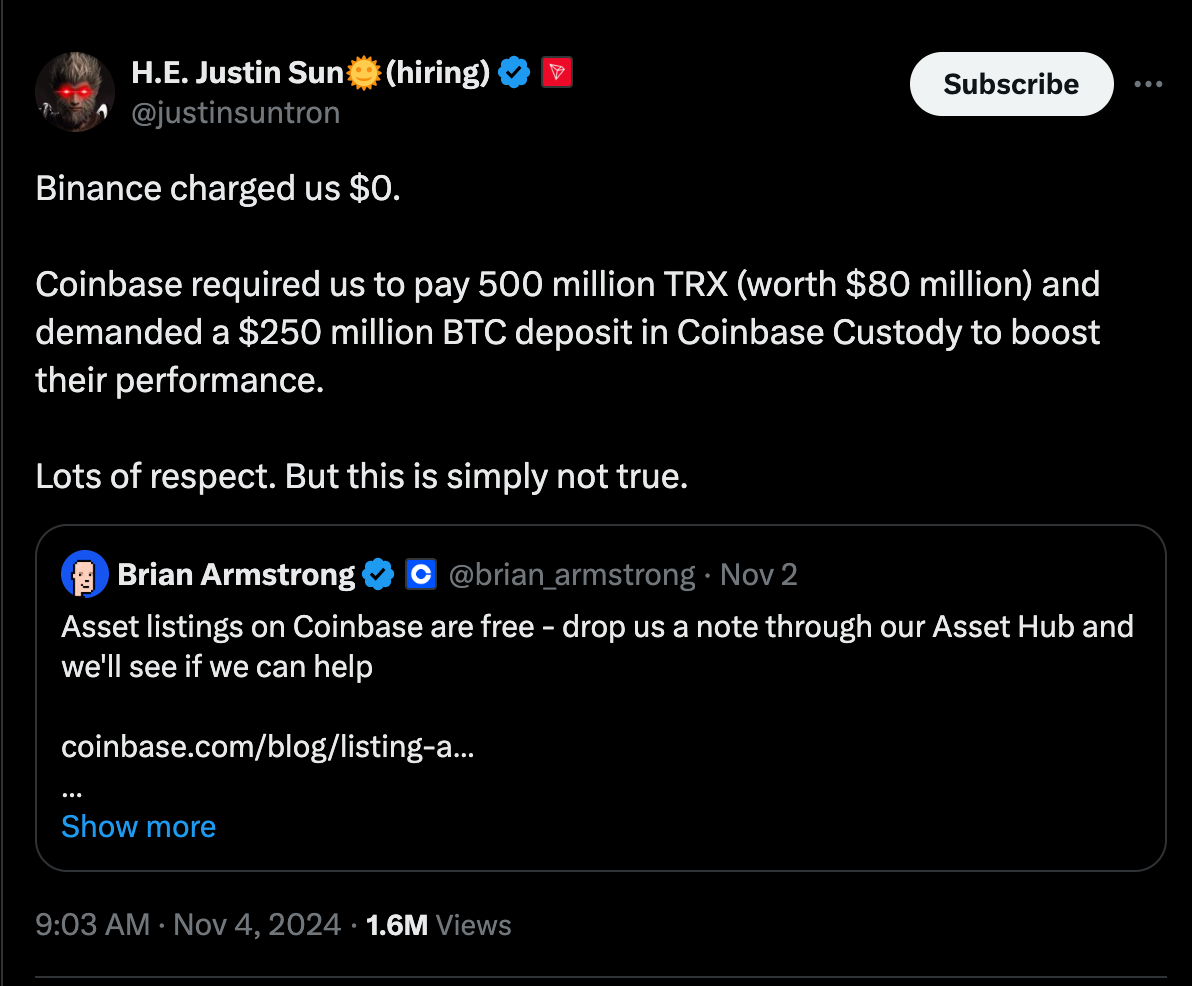

A big level of controversy entails claims made by TRON founder Justin Solar, who alleges that Coinbase demanded exorbitant charges to record TRON (TRX). Based on Solar, Coinbase requested 500 million TRX tokens, roughly equal to $80 million on the time, for the itemizing. Solar’s allegations contradict Coinbase CEO Brian Armstrong’s assertion that the change provides free cryptocurrency listings. This disagreement has fueled a broader debate throughout the crypto trade relating to transparency and equity in change itemizing charges.

Supply

In response, Armstrong reaffirmed that Coinbase doesn’t cost charges for token listings and encourages initiatives to use freely. Nevertheless, Solar’s assertion was rapidly supported by different outstanding figures, together with Andre Cronje, founding father of the Fantom undertaking, who revealed his expertise with Coinbase looking for funds between $30 million and $300 million for varied listings over time. The alleged excessive prices are seen as a big barrier for rising crypto initiatives, which can lack the sources to fulfill such calls for, finally limiting variety and innovation throughout the market.

Affect of Itemizing Charges on the Crypto Group

The continuing dialog about Coinbase’s itemizing practices touches on a broader challenge throughout the cryptocurrency ecosystem. When platforms like Coinbase impose excessive itemizing charges, smaller initiatives are successfully priced out, decreasing their probabilities of success. Some argue that this restriction stifles competitors and slows the trade’s development.

A latest report from a enterprise capitalist highlighted an occasion the place a high-profile undertaking was requested for 15% of its complete token provide for a list. Such practices, if true, pose a substantial problem to the accessibility and inclusivity of the digital asset market. Because the trade matures, requires better transparency and equitable practices round itemizing charges will seemingly enhance, placing additional stress on exchanges like Coinbase.

Controversial Publication Description of Pepe Coin Sparks Backlash

Coinbase’s inner challenges are compounded by a social media backlash following a e-newsletter article describing the meme coin Pepe as “a hate image co-opted by alt-right teams.” This reference, attributed to the Anti-Defamation League, has unsettled many within the cryptocurrency neighborhood, who argue that Pepe represents an web meme with no political agenda. The meme coin, named after the favored web character Pepe the Frog, not too long ago surged. It reached a $1 billion market cap inside days of its launch earlier than seeing a subsequent decline.

Critics of the e-newsletter, together with crypto neighborhood figures like Spottie WiFi and Kenobi, expressed their disappointment with Coinbase’s characterization of Pepe. Kenobi, a musician and educator, introduced his intention to shut his Coinbase account over the remarks, reflecting the sturdy sentiment throughout the neighborhood. Though Coinbase issued a disclaimer stating that the views within the article didn’t replicate these of the corporate, the harm to its fame amongst some segments of the person base seems important.

SEC Fees Coinbase with Working as an Unregistered Change, Dealer, and Clearing Company

Past public relations points, Coinbase faces extreme regulatory challenges. On June 6, 2023, the SEC charged Coinbase with working as an unregistered nationwide securities change, dealer, and clearing company. The regulator alleges that Coinbase has facilitated billions of {dollars} in crypto asset securities transactions with out the required registration, depriving traders of important protections.

Based on the SEC’s grievance, Coinbase combines the roles of an change, dealer, and clearing company — companies usually separated in conventional finance. The SEC claims that by working on this method with out registration, Coinbase bypasses important safeguards, equivalent to rulebooks, to forestall fraud and conflicts of curiosity, together with routine inspections by the Fee. The regulator’s motion extends to Coinbase’s staking-as-a-service program, which the SEC argues constitutes an unregistered securities providing.

The SEC’s grievance alleges that Coinbase World Inc. (CGI), Coinbase’s holding firm, bears accountability for these violations. The grievance seeks injunctive reduction, disgorgement of good points, and penalties, emphasizing the SEC’s intent to carry Coinbase accountable for allegedly sidestepping federal securities legal guidelines.

SEC’s Enforcement and Crypto Regulation

The SEC’s crackdown on Coinbase underscores the company’s broader regulatory push throughout the crypto trade. SEC Chair Gary Gensler acknowledged that Coinbase’s alleged mixing of change, dealer, and clearinghouse features units a harmful precedent by depriving traders of vital protections. Gensler argued that whereas Coinbase might have earned billions by these operations, it did so on the expense of investor safeguards mandated by regulation.

The enforcement motion in opposition to Coinbase is a component of a bigger initiative by the SEC’s Crypto Property and Cyber Unit, which has intensified its scrutiny of cryptocurrency exchanges. Coinbase, for its half, contends that it has operated in good religion and throughout the bounds of current regulation. Nonetheless, the end result of this case might have far-reaching implications for the cryptocurrency trade, as different exchanges carefully monitor the developments.

Coinbase’s Future Amid its challenges

As Coinbase navigates these overlapping controversies, its future within the U.S. market faces rising uncertainty. The allegations round itemizing charges, compounded by neighborhood discontent over the Pepe description and extreme authorized battles with the SEC, replicate a pivotal second for the change. Whether or not Coinbase can deal with these points whereas retaining person belief and complying with regulatory requirements stays to be seen.

Coinbase’s authorized wrestle with the SEC has important implications for its operations and the crypto trade’s regulatory panorama. If the SEC prevails, different exchanges might face comparable regulatory pressures to separate change, dealer, and clearing features, probably reshaping the operational fashions of crypto platforms in the USA.

Coinbase’s latest controversies illustrate the advanced and sometimes conflicting pressures dealing with cryptocurrency exchanges in at present’s regulatory surroundings. The change’s itemizing practices, neighborhood relations, and compliance with securities legal guidelines have come beneath scrutiny, and the stakes are excessive for each Coinbase and the broader trade. Because the SEC’s authorized motion progresses and public sentiment stays combined, the end result of those challenges might set the tone for the way the U.S. cryptocurrency sector navigates regulation and transparency within the years forward.