Ethereum Holds Floor: What’s Subsequent for ETH Worth?

Ethereum (ETH) is exhibiting resilience because it continues to commerce above a key assist zone close to $1,800. Whereas short-term efficiency stays modest, the technical construction means that ETH could also be gearing up for one more upward leg. After a pointy bounce from the $1,500 vary, the present sideways motion seems to be a consolidation part earlier than the following main push.

As of now, Ethereum is buying and selling at $1,830, with the next efficiency metrics:

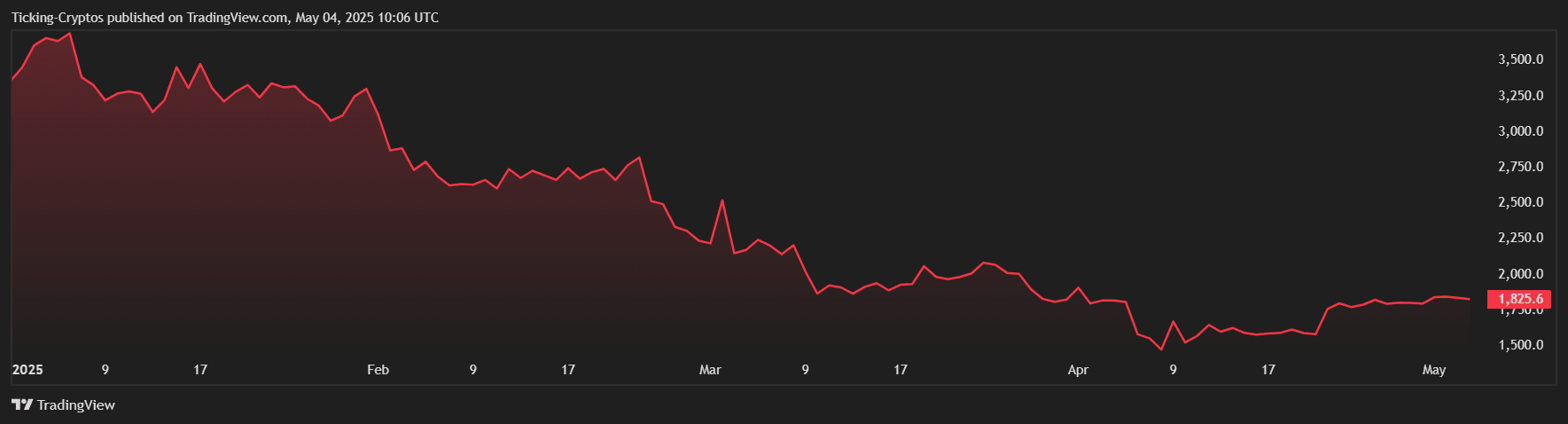

- 1-Day Efficiency: +0.03%

- 1-Week Efficiency: +0.84%

- 1-Month Efficiency: -0.23%

- YTD Efficiency: -41.11%

Regardless of the yearly downtrend, current actions level to rising purchaser curiosity close to the $1,800 mark.

ETH/USD YTD chart – TradingView

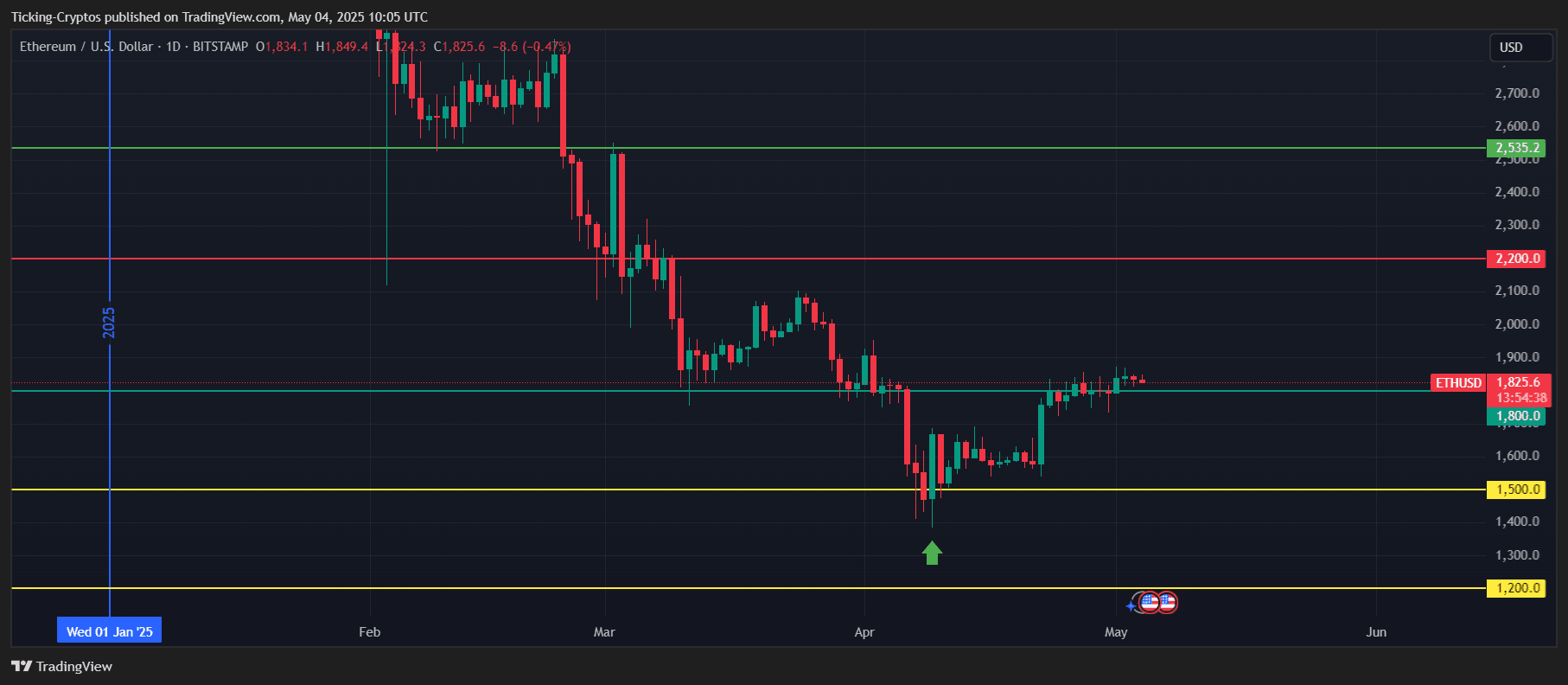

Ethereum Worth Prediction: Targets Forward if Help Holds

ETH’s robust restoration from the $1,500 degree laid the inspiration for a bullish setup. If costs proceed to carry above $1,800, the following key targets lie at:

- $2,000 – a psychological and historic resistance degree

- $2,200 – aligning with previous swing highs

- $2,500 – a significant bullish milestone if momentum continues

ETH/USD 1-day chart – TradingView

This consolidation between $1,800–$1,850 might be interpreted as accumulation by long-term traders earlier than a breakout.

Bearish State of affairs: What if ETH Crash Under $1,800?

Whereas the present outlook is cautiously optimistic, merchants ought to monitor the $1,800 assist carefully. If Ethereum breaks down from this degree, the market might revisit the $1,500 assist zone. A sustained transfer beneath $1,800 would possibly sign a shift in sentiment and stall bullish momentum.

A Make-or-Break Stage for Ethereum Worth

Ethereum’s worth motion across the $1,800 zone is crucial. The continuing consolidation could pave the best way for a breakout towards $2,000 and past—however provided that assist holds. Merchants and traders alike are watching carefully, as ETH prepares for its subsequent transfer.