Ethereum struggles close to $1,600 as whales offload 143K ETH and derivatives inflows spike. Will ETH crash beneath $1,400?

With Bitcoin stagnating close to $84k, Ethereum fails to set off a trendline breakout rally. ETH is at present buying and selling at $1,581, following the formation of a each day Doji candle.

As Ethereum continues to underperform, whales have begun offloading this week, and the community has recorded a brand new low. Can Ethereum handle to carry the $1,400 assist degree amidst these circumstances?

Ethereum Caught at a Crossroads: Will Bears Take Management?

Ethereum fails to bounce again throughout the falling channel sample within the each day chart. Going through opposition from a newly fashioned resistance trendline throughout the channel, the ETH value fails to drift above $1,600.

The upper value rejection within the current each day candle with lengthy wicks warns of a possible drop forward. Nonetheless, technical indicators counsel an optimistic probability.

The each day RSI line reveals a sideways motion, hovering simply above the oversold boundary after a slight uptick. Moreover, the MACD and sign traces have given a constructive crossover, albeit nonetheless inside damaging territory.

These technical alerts point out the potential of a brand new bullish wave throughout the ongoing decline.

Based mostly on Fibonacci ranges, a breakout rally may first goal the 23.60% Fibonacci degree close to $2,000. If bulls handle to interrupt above the higher boundary, the 38.20% degree close to $2,400 turns into the following probably value goal.

Conversely, Ethereum reveals robust assist round $1,400. A each day shut beneath this degree may set off a possible drop towards $1,000.

Ethereum Offloading Season Begins?

Over the previous week, Ethereum skilled a minor surge adopted by stagnation, prompting whales to exit. Based on a current tweet by crypto analyst Ali Martinez, Ethereum whales have offloaded 143,000 ETH, valued at over $226 million.

This important offloading has decreased the stability of wallets holding 100–1,000 ETH from 9.4325 million to 9.2894 million. One notable case stands out.

Whales have offloaded 143,000 #Ethereum $ETH over the previous week! pic.twitter.com/n8cmwyUpER

— Ali (@ali_charts) April 17, 2025

One standout case: a long-dormant whale returned to the market after two years and deposited 1,161.77 ETH (price $1.84 million) into Kraken.

The entity realized a revenue of $ 480 Okay. Initially, the whale withdrew 943 ETH (then price $1.11 million) from Binance and later swapped 253.73K USDC for 146.59 stETH for staking.

By staking Ethereum, the whale earned a further 72 ETH.

Lowest Ethereum Transaction Prices in 5 Years

Amid falling ETH costs, the community has hit a five-year low in transaction charges. Based on Santiment, Ethereum’s common community charge has dropped beneath $0.17 for the primary time since Might 2020. At the moment, the typical transaction prices simply $0.168.

Declining charges counsel weakening demand and decreased person exercise, each potential precursors to a decrease ETH market valuation.

🚨💸 BREAKING: Ethereum charges are at a 5-year low, with transactions at present costing simply $0.168. That is the most affordable each day value of creating $ETH transfers since Might 2, 2020. We briefly break this down in our newest perception. 👇https://t.co/fg5CfRgsHn pic.twitter.com/QlLwyzdm1F

— Santiment (@santimentfeed) April 16, 2025

As Ethereum struggles at a crossroads with the shaken confidence of whales, the derivatives market information a large influx. Traditionally, main influx spikes in Ethereum derivatives have resulted in main crashes.

On March 26, an influx of almost 65K ETH led to a 13% drop over 4 days. An identical spike final week resulted in a virtually 20% decline.

On April 16, the biggest spike but — over 77K ETH — triggered fears of a deeper correction.

As Ethereum struggles to carry bullish floor, the elevated influx spike may result in a leverage-driven downfall to $1,000.

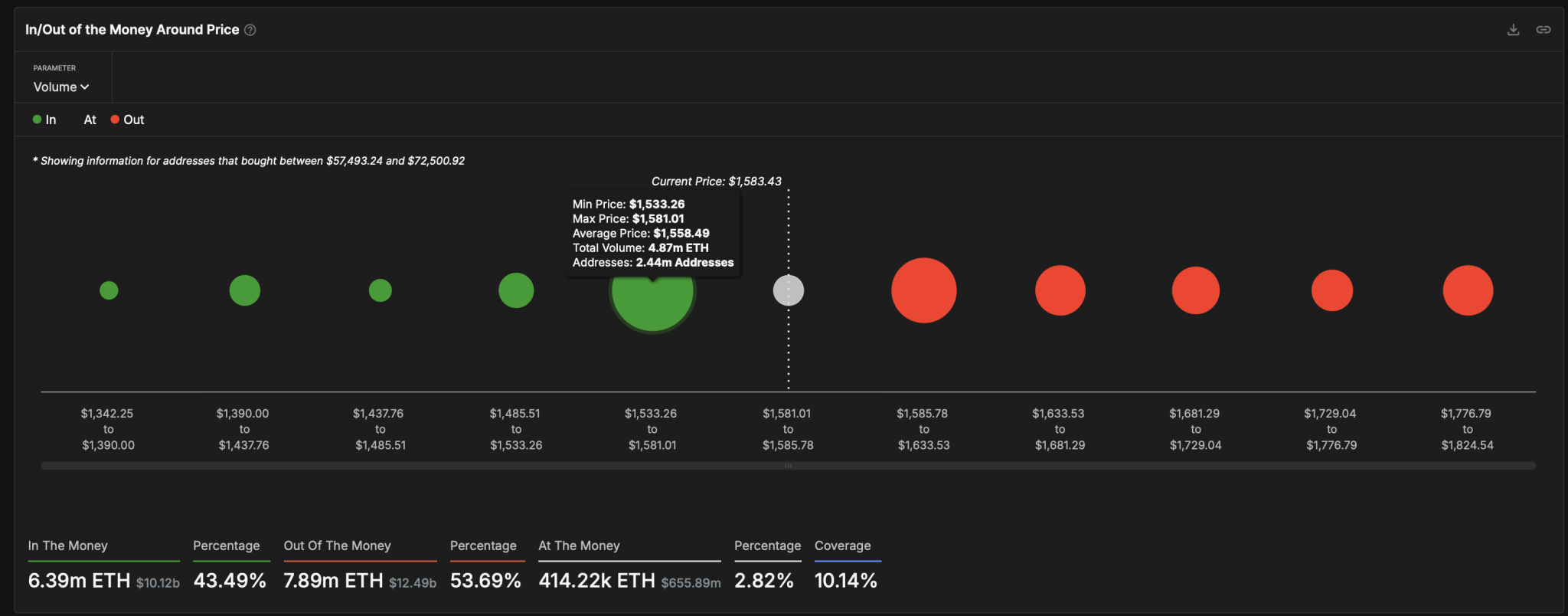

Based mostly on the In/Out of Cash Indicator from IntotheBlock, the assist zone between $1,533 and $1,581 is the ultimate protection line. This demand zone holds 4.82 million ETH in 2.44 million addresses. If the worth drops beneath this vary, the following assist lies between $1,390 and $1,437.

Ethereum GIOM Indicator

Conversely, the important thing resistance stays the availability zone between $1,585.78 and $1,633.53, which holds 2.89 million ETH throughout 3.62 million addresses.

A profitable breakout may see ETH rise towards the $1,700 degree.