Ethereum (ETH) merchants have watched carefully as giant holders started making main on-chain strikes this week.

The cryptocurrency surged above key resistance at $1,620, reaching a excessive close to $1,705 earlier after which pushing to just about $1800.

Market contributors have questioned whether or not this momentum may push Ethereum to $1,850.

Nonetheless, latest whale transactions and on-chain exercise could affect the path of the worth within the quick time period.

Ethereum Surges Previous Key Resistance as Value Targets $1,850

Ethereum began a robust bullish motion because it exited its buying and selling vary at $1,555 to $1,620.

The worth exceeded resistance ranges to hit its new highest level at $1,705 throughout this quick interval.

The upward motion occurred after Ethereum traded sideways for a number of days, thereby growing assist to extend.

After hitting $1,705, the Ethereum value met resistance close to $1,720 and began consolidating above the $1,693 stage.

Market analysts shared charts indicating a bullish continuation was attainable if Ethereum held assist above $1,693.

A breakdown under this level may open the door for a retest of assist zones at $1,660 and $1,620.

Market contributors constantly noticed quantity ranges to validate enduring purchaser participation.

Skilled analysts predict that if the worth surpasses $1,720, it can increase the potential for costs to rise towards $1,850.

Supply: X

Analyzing the ETH/BTC value pair added complexity to the examine. The relative worth of Ethereum in comparison with Bitcoin skilled a greater than 79% lower from its highest level in 2021.

The buying and selling pair maintained a place near 0.01835, one in all its lowest factors throughout its multi-year historical past.

A change in market sentiment in the direction of Ethereum’s ecosystem and constructive emotions in the direction of its community would result in a possible ETH/BTC relationship.

Whale Transactions Increase Issues Over Quick-Time period Promoting

Giant holders made a number of notable transactions following Ethereum’s value surge. A pockets linked to the Ethereum Basis transferred 1,000 ETH, value round $1.58 Million, to the change Kraken.

In keeping with blockchain information, this pockets acquired 84,513 ETH a decade in the past when the asset was priced at roughly $1.20.

One other giant transaction got here from a whale that borrowed 15,000 ETH from Aave and offered it for twenty-four.9 million USDT.

The typical promoting value was round $1,660. This transfer occurred shortly after the latest value rally, resulting in considerations that different giant holders may comply with with comparable actions.

After the $ETH value rose, a whale borrowed 15,000 $ETH from #Aave and dumped it for twenty-four.9M $USDT at a median value of $1,660.https://t.co/9x1ZEatzZE pic.twitter.com/vImz9wAUrc

— Lookonchain (@lookonchain) April 22, 2025

In keeping with a blockchain analyst, the transaction occurred inside quarter-hour. The speedy transaction and its giant quantity made some buyers fear about intense market vendor affect.

On-Chain Metrics Level to Attainable Accumulation Zone

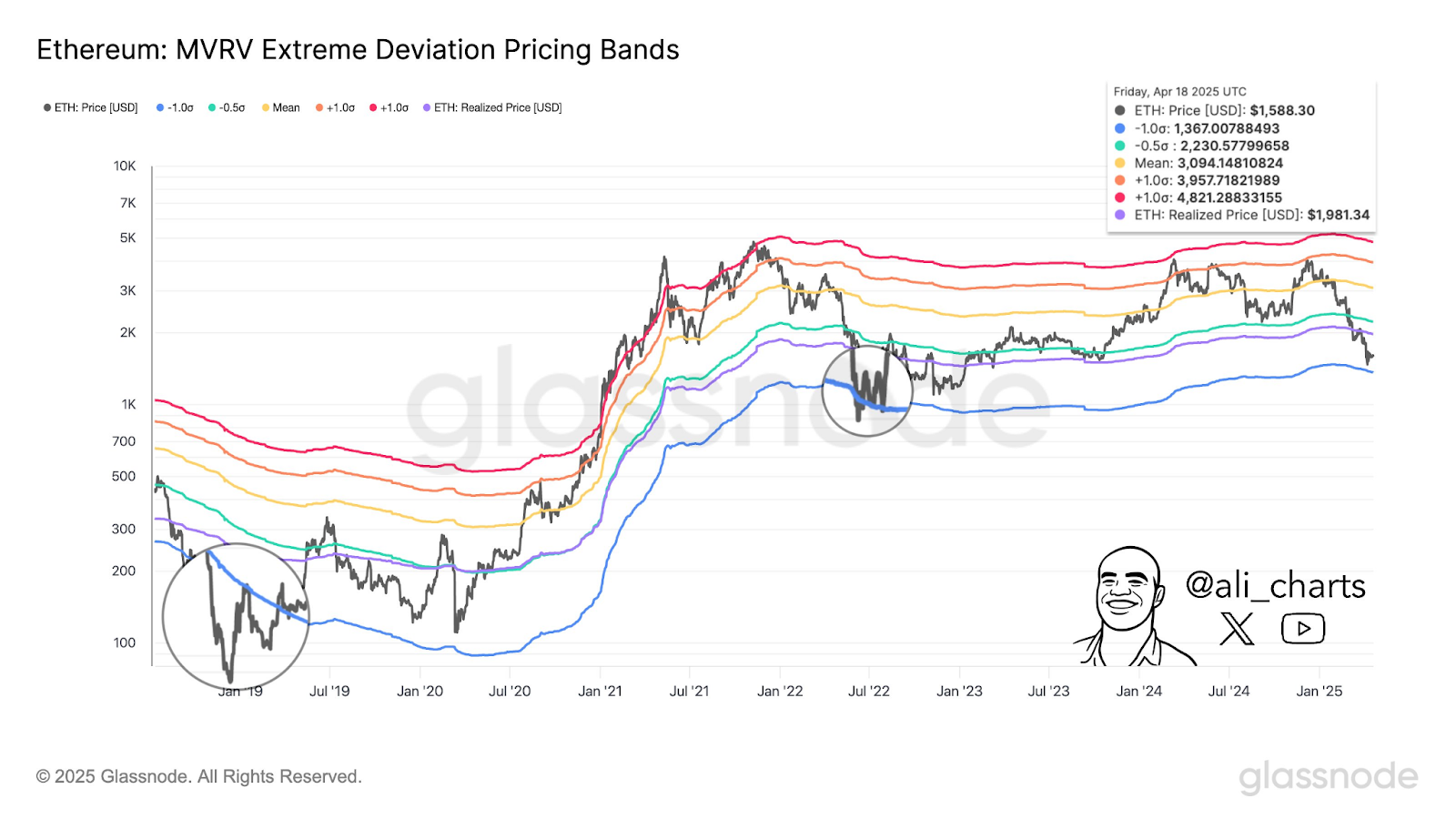

Ethereum’s MVRV Pricing Bands offered an alternate perspective in regards to the asset’s market standing throughout April 2025.

The market valued Ethereum at $1,588.30, whereas its precise worth remained at $1,981.34.

Ethereum is positioned inside the decrease part of MVRV deviation bands, the place historic knowledge exhibits shopping for exercise steers in the direction of accumulation.

Glassnode knowledge indicated that the earlier falls into these bands throughout 2018 and 2022 established market backside factors.

Analysts adopted this knowledge level because it revealed the emotions of long-term holders and market actors in Bitcoin markets.

The worth vary signifies ongoing promoting or weak demand if it stays steady for a chronic interval.

Supply: X

The present value acquired constructive and detrimental assessments from merchants due to whale transactions and broader market situations.

The Ethereum market confirmed indicators of recovering to succeed in earlier MVRV bands, together with the $3,094 mark.