Ethereum has dropped under $2,500 amid rising bearish momentum. With lengthy liquidations surging and the RSI weakening, ETH dangers falling towards the $2,000 mark.

As Bitcoin dangers dropping the $105,000 stage, Ethereum has dipped under $2,500. Dealing with a steeper correction and rising draw back danger, can Ethereum maintain above the 200-day EMA, or will it slide to $2,019?

Ethereum Worth Evaluation

On the every day chart, Ethereum stays in a sideways pattern regardless of a greater than 7% drop on Thursday. Following a short-term restoration, Ethereum is holding above the 38.2% Fibonacci retracement stage close to $2,400.

With this transient rebound, Ethereum has moved again above the 200-day EMA at $2,461. Nonetheless, with an intraday pullback of almost 1% after Sunday’s Doji candle, ETH alerts a attainable decline towards the 38.2% Fibonacci stage.

The RSI indicator suggests a bearish finish to the consolidation section, because the RSI line tendencies downward towards the midpoint. A bearish divergence can be rising, indicating a gradual enhance in bearish strain and heightened draw back danger.

Based on Fibonacci ranges, a every day shut under the 38.2% retracement could lead on ETH towards the psychological $2,000 stage, slightly below the 23.6% Fibonacci stage.

Nonetheless, intermediate assist from the 50-day and 100-day EMA traces at $2,357 and $2,319 might function key defenses. On the bullish aspect, any potential reversal would possible face resistance on the 50% Fibonacci stage, round $2,699.

Lengthy Liquidations Hit $26 Million

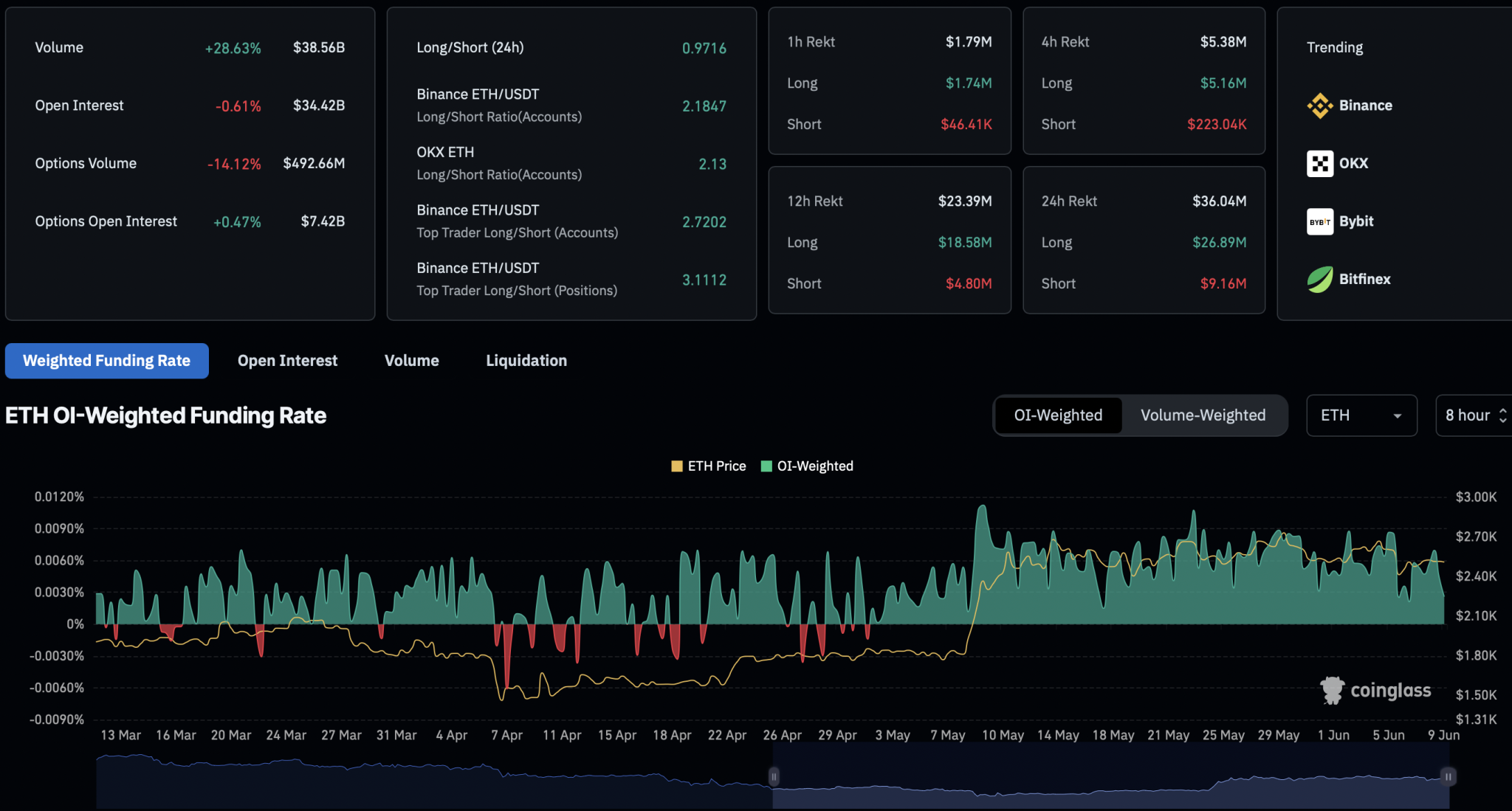

With the intraday pullback, sellers are gaining the higher hand in Ethereum derivatives. Over the previous 24 hours, lengthy liquidations surged to $26.89 million, whereas brief liquidations had been at $9.16 million.

ETH Derivatives

Following this wipeout of bullish positions, the long-to-short ratio now stands at 0.97, indicating the next variety of brief positions. In response, open curiosity has declined by 0.61% to $34.42 billion, reflecting diminished dealer participation.

Bullish sentiment has additionally cooled, because the OI-weighted funding fee dropped from 0.0070% to 0.0026%. These metrics from CoinGlass underscore bearish dominance in Ethereum derivatives.

Establishments Increase Ethereum Holdings

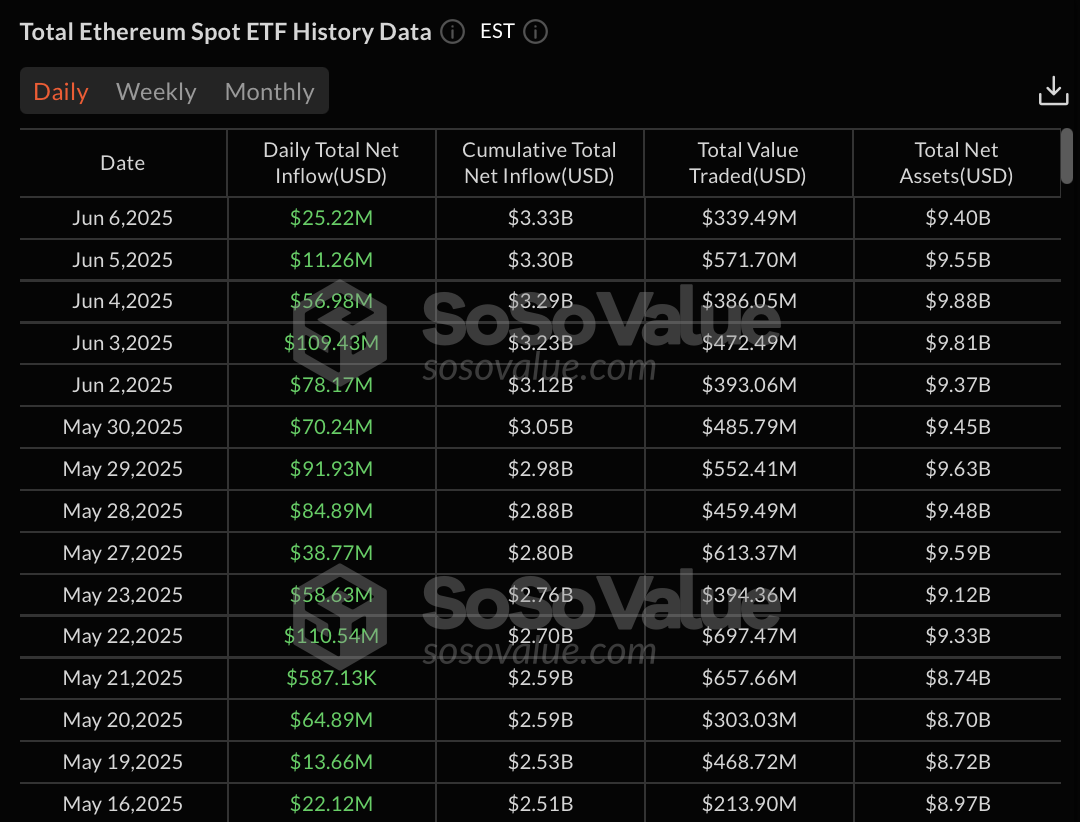

Regardless of retail merchants displaying weak spot within the derivatives market, institutional assist for Ethereum stays robust. ETFs look like rotating capital from Bitcoin ETFs into Ethereum.

U.S. spot Ethereum ETFs have recorded 15 consecutive days of inflows, totaling over $837 million. On June 6, the online every day influx reached $25.22 million, led by $15.86 million from BlackRock and $9.37 million from Grayscale.

ETH ETFs Circulation