A Bitcoin pockets courting again to the cryptocurrency’s earliest days has simply come to life after greater than 14 years of inactivity.

The handle, believed to have mined round 4,000 BTC between April and June 2009, transferred 150 BTC this week — the primary motion since June 2011.

Uncommon Motion from the Early Bitcoin Period

The cash, value simply $67,724 when final energetic, are actually valued at roughly $16 million. On-chain information exhibits the pockets initially consolidated its mined BTC right into a single handle in 2011 and had remained untouched since.

A Satoshi-era pockets that mined 4,000 BTC between April and June 2009 – simply months after Bitcoin’s launch – and consolidated every little thing into one pockets in June 2011, has simply transferred out 150 BTC after 14.3 years of dormancy.

It was value $67,724 again in 2011.

Now that very same…

— MLM (@mlmabc) October 23, 2025

Transfers from Satoshi-era wallets are extraordinarily uncommon. Information from Glassnode suggests solely a handful of pre-2011 wallets transfer funds annually.

The cash from this era have been mined when Bitcoin’s creator, Satoshi Nakamoto, was nonetheless energetic in on-line discussions, making such actions a magnet for hypothesis.

Traditionally, old-wallet awakenings set off short-term jitters available in the market. Merchants usually interpret these strikes as early holders making ready to promote, sparking fears of enormous inflows to exchanges.

Nonetheless, in most previous circumstances, the cash weren’t offered however merely moved to new addresses for safety, inheritance, or consolidation functions.

Bitcoin Value Chart In October. Supply: BeInCrypto

Why the Timing Issues

The transfer comes as Bitcoin trades round $110,000, consolidating after a steep drop from its current all-time excessive above $126,000 earlier this month.

The market is recovering from the most important liquidation occasion in crypto historical past, with $19 billion worn out throughout leveraged positions.

Sentiment stays fragile. Any sign suggesting potential promote stress — particularly from long-dormant wallets — can amplify warning.

Nonetheless, the 150 BTC switch represents a negligible share of day by day Bitcoin buying and selling quantity, which exceeds $20 billion, making the market impression principally psychological.

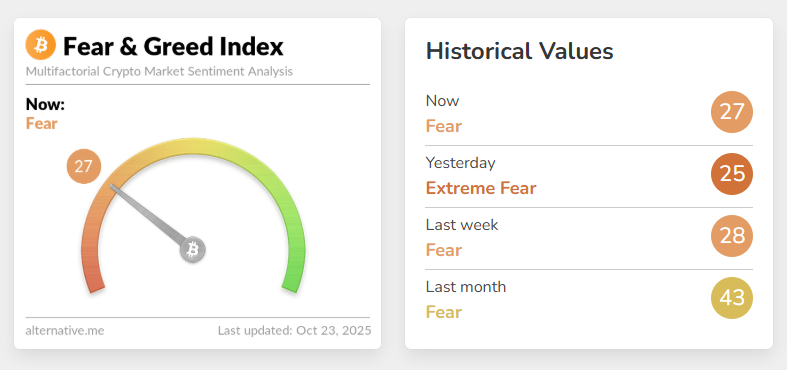

Crypto Concern and Greed Index. Supply: Different

Doable Explanations

There are a number of believable causes behind the transfer. The proprietor could possibly be migrating cash to a contemporary, safe pockets, executing property planning, or testing transaction performance.

Until the funds are later traced to exchange-linked addresses, it’s unlikely that the cash have been offered.

Comparable awakenings in 2021 and 2023 didn’t result in sustained value drops. These transactions have been finally linked to private reorganization somewhat than liquidations.

Market Context and Implications

The Bitcoin market has been risky in current weeks, formed by macroeconomic rigidity and heightened sensitivity to on-chain information.

With costs consolidating between $108,000 and $111,000, merchants are in search of course amid fears of additional corrections.

On this setting, old-wallet actions act as symbolic reminders of Bitcoin’s early decentralization — and the immense fortunes nonetheless sitting dormant.

For traders, until these cash attain change wallets, such awakenings maintain psychological weight, not market-moving energy.

Backside Line

The 14-year-old pockets’s exercise is a historic anomaly somewhat than a harbinger of main market shifts. It displays Bitcoin’s longevity and the huge untapped wealth from its earliest mining period.

For now, the market continues to observe carefully — however the transfer seems extra like digital housekeeping than a sign of imminent promoting.

The put up Satoshi-Period Bitcoin Whale Awakens After 14 Years: Will It Transfer BTC Value? appeared first on BeInCrypto.