Knowledge exhibits the stablecoins USDT and USDC have been seeing capital inflows lately, one thing that would turn into bullish for Bitcoin.

High 2 Stablecoins Have Seen Their Market Caps Develop Just lately

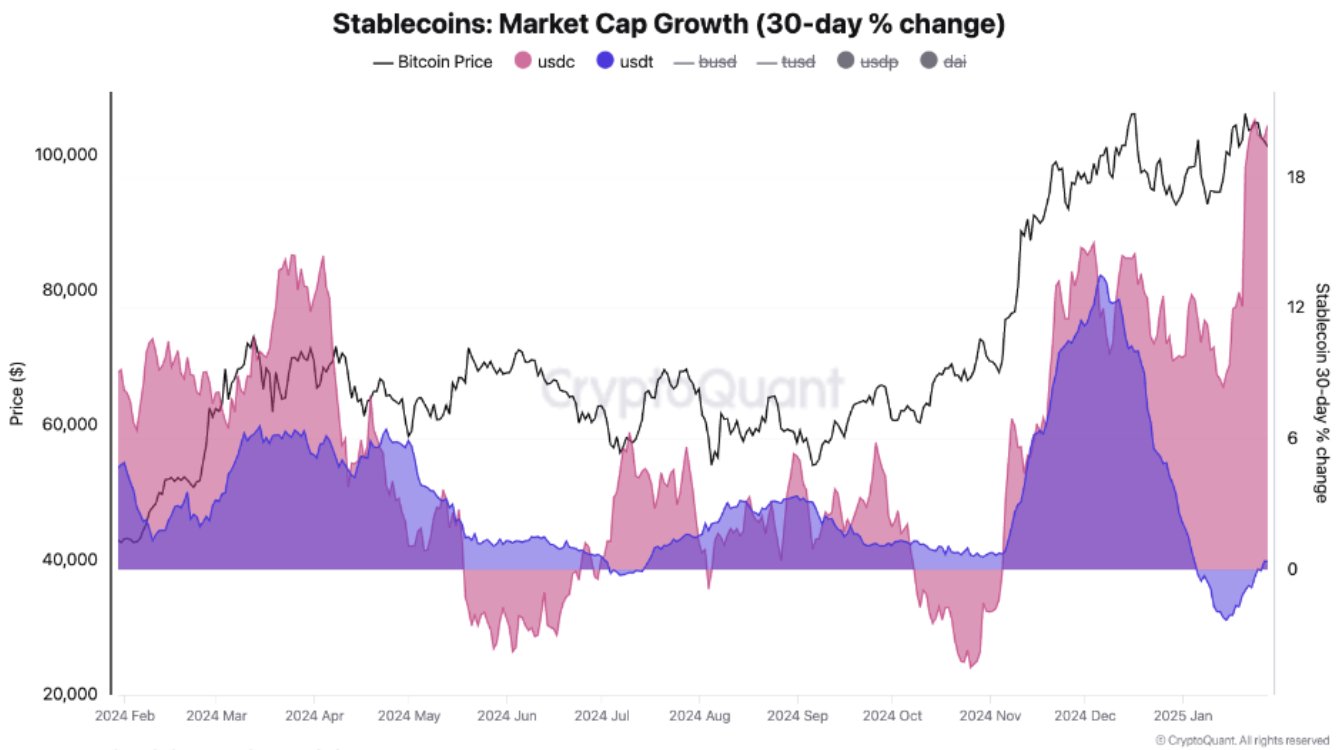

In a brand new submit on X, the on-chain analytics agency Santiment has mentioned concerning the newest development available in the market caps of the highest two stablecoins: USDT and USDC. Beneath is the chart shared by the analytics agency, that exhibits the information for the 30-day change available in the market caps of the 2 cryptocurrencies.

As is seen within the graph, the 30-day share change available in the market cap of USDC has spiked to sharp constructive ranges lately, implying that the stablecoin has been rising at a speedy price.

Not like USDC, which has seen sustainable progress for the previous few months, USDT kicked off the 12 months 2025 with its 30-day market cap change dipping into the destructive territory. Since bottoming at round -2% earlier within the month, although, momentum has returned for the asset because the indicator has simply turned again inexperienced.

Which means at current, each of the 2 stablecoin giants are having fun with a rise of their market caps. Traditionally, progress in these fiat-tied tokens is one thing that has been bullish for Bitcoin and different unstable cryptocurrencies.

The rationale behind that is the truth that traders who retailer their capital within the type of stablecoins typically plan to speculate into the unstable facet of the market ultimately. After they purchase BTC with their stables, its worth naturally receives a constructive impact.

Probably the most bullish state of affairs for the sector happens when each Bitcoin and the stablecoins witness an increase of their market caps. Such a setup implies each side of the market are getting internet capital inflows. When just one rises whereas the opposite goes down, it means capital is merely seeing a rotation between the 2.

The latest inflows into USDT and USDC have come whereas BTC has been consolidating sideways. This implies the capital coming into into the stables is recent, as BTC would have gone down if it was in any other case. On the similar time, BTC itself isn’t seeing any direct inflows, therefore the flat worth motion.

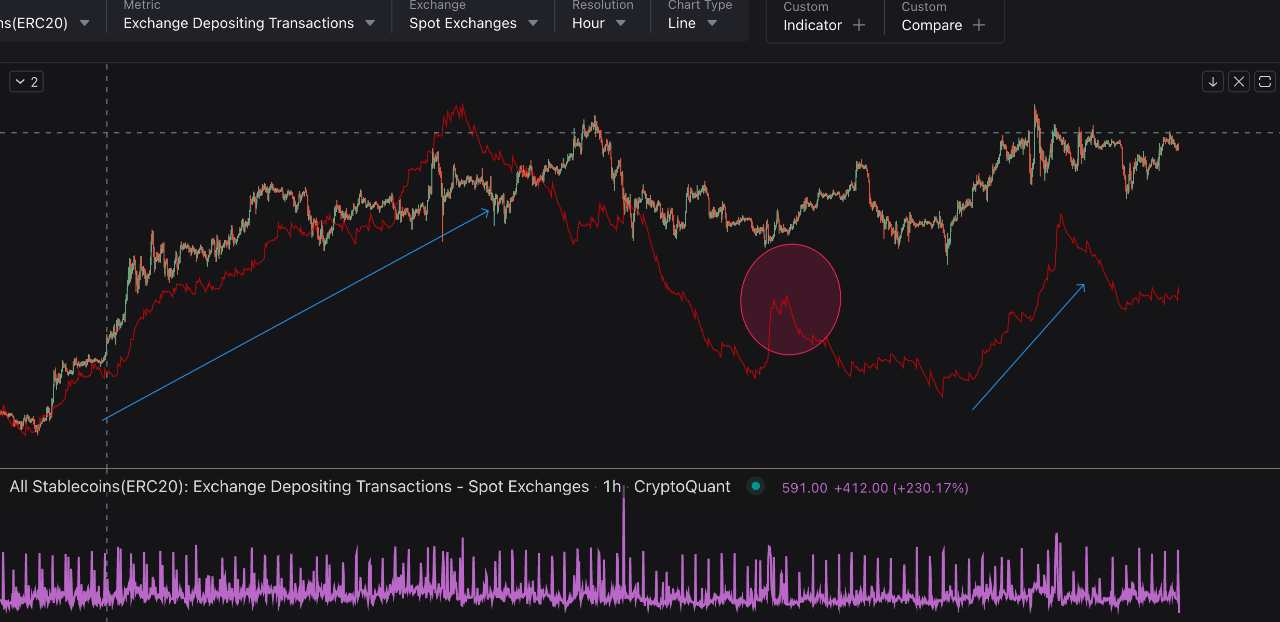

Normally, stablecoin holders deposit to centralized exchanges after they need to buy the unstable cryptocurrencies. Thus, the variety of steady deposits into these platforms can inform us about whether or not large-scaling shopping for of this sort is occurring or not.

An analyst has shared the information for the metric in a CryptoQuant Quicktake submit.

From the above chart, it’s obvious that the indicator is following a flat trajectory proper now. A rise in it, just like the one witnessed earlier, might present gas for an additional rally for Bitcoin.

Bitcoin Value

On the time of writing, Bitcoin is floating round $104,800, down 1% within the final week.

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com