On-chain inflows proceed to surge, and conventional rails are experiencing mass inflows. The pattern is effectively illustrated by exchange-traded product (ETP) supplier WisdomTree’s real-world asset (RWA) fund — the WisdomTree Authorities Cash Market Digital Fund (WTGXX) has exploded in worth during the last three months, reaching new highs final week.

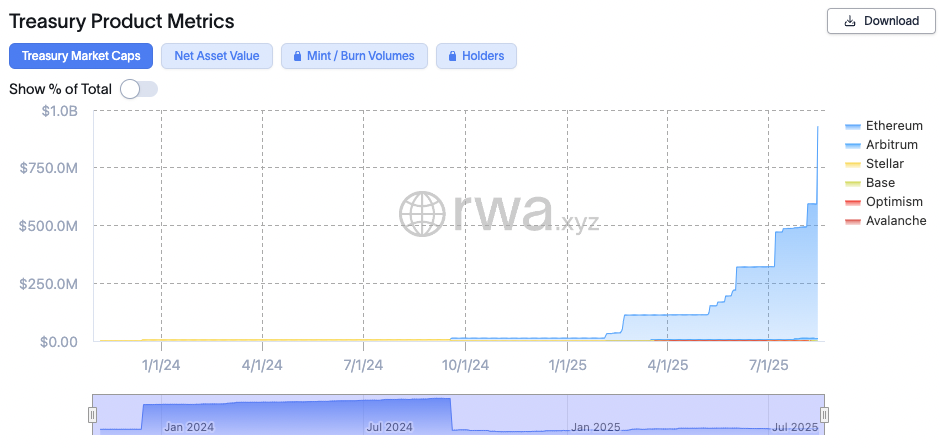

WTGXX, which represents tokenized U.S. treasuries throughout a number of blockchain networks, added one other $330 million to its whole worth locked in simply sooner or later final week, taking its whole to over $931 million as of right this moment, Aug. 18. The inflow marks a 90% enhance over the previous month, and a 722% enhance since Could, in line with RWAxyz information.

WTGXX TVL. Supply RWAxyz

The fund is totally on Ethereum, with $919 million of its TVL on the second largest blockchain. The remainder of WTGXX worth is on Arbitrum and Stellar.

The RWA market has grown exponentially during the last two years, from $8.6 billion the start of 2024, to $26.6 billion as of August 2025. The surge is led by tokenized non-public credit score loans, which at the moment account for 59% of the full RWA market, and on-chain tokenized treasury funds like WTGXX and BlackRock’s BUIDL.

BUIDL is the most important tokenized treasury fund, with $2.4 billion belongings underneath administration (AUM), whereas WTGXX is now the third largest, due to its current TVL surge.

The expansion in WTGXX comes alongside an ecosystem-wide enlargement led by Ethereum’s robust worth motion just lately. Over the past week, the Ethereum and Solana ecosystems have hit new highs, whereas DeFi lending markets are additionally at all-time highs as capital pours on-chain.

RWA tokenization platform Centrifuge just lately surpassed the $1 billion mark in TVL, per information from DefiLlama.