XRP’s value breakout goal evaluation reveals the coin might hit $2.42 quickly, and a few daring predictions even recommend $26 if international asset tokenization truly occurs. XRP $2.42 prediction fashions proper now are pointing to technical alerts that again this escape, and international asset tokenization concepts together with XRP treasury hypothesis are pushing these longer-term value targets. Ripple institutional banking developments, together with the corporate’s U.S. banking constitution software, are additionally reshaping market expectations for this XRP value breakout goal.

XRP’s Value Breakout, $2.42 Prediction, and Treasury Hypothesis Unfold

Technical Breakout Indicators Level to $2.42 Goal

XRP’s value breakout targets in the present day point out that the cryptocurrency has gained keep energy above the pivot assist level at across the $2.09 value level which coincides with the 200-day shifting common. The XRP prediction of $2.42 positive aspects gentle as a result of the Level of Management is at as at 2.42 as it’s the subsequent logical resistance level. The commerce quantity is at the moment at pretty low ranges and that is often indicative of accumulation earlier than potential breakout.

Banking Constitution Transforms Institutional Outlook

🚨⚠️ RIPPLE JUST APPLIED FOR A US BANK CHARTER.

This is not simply massive—it might rewrite XRP’s future.

What it truly means for XRP and RLUSD may shock you.

Let me break it down in easy phrases.🧵👇🏻 pic.twitter.com/e3MW76EHdw

— All Issues XRP (@XRP_investing) July 2, 2025

The dialogue of XRP value break outs has been fuelled by Ripple requesting a U.S. nationwide banking constitution. This Ripple institutional banking step crops the corporate to develop its regulatory compliance in addition to direct entry to the Federal Reserve through the subsidiary Commonplace Custody.

Brad Garlinghouse stated:

“If authorized, we’d have each state (through NYDFS) and federal oversight, a brand new (and distinctive) benchmark for belief within the stablecoin market.”

Treasury Hypothesis Fuels Lengthy-Time period Projections

Get into $XRP earlier than the following BIG announcement:

The U.S. Treasury quietly secured management over a part of the XRP escrow again in mid-2020.

They known as me loopy after I stated @Ripple would grow to be a financial institution.

Now watch all of it unfold.— EDO FARINA 🅧 XRP (@edward_farina) July 2, 2025

XRP treasury hypothesis facilities on claims about U.S. authorities involvement in XRP’s escrow system. This story underpins high-paced international asset tokenization use instances wherein XRP value breakout goal estimates go to as much as $26 or much more. As of writing these claims aren’t confirmed by official sources.

Edoardo Farina additionally stated:

“The U.S. Treasury quietly secured management over a part of the XRP escrow again in mid-2020.”

Tokenization Situations Drive Excessive Valuations

the entire world will likely be tokenized

— Dom (Bull/ish) | EasyA (@dom_kwok) July 1, 2025

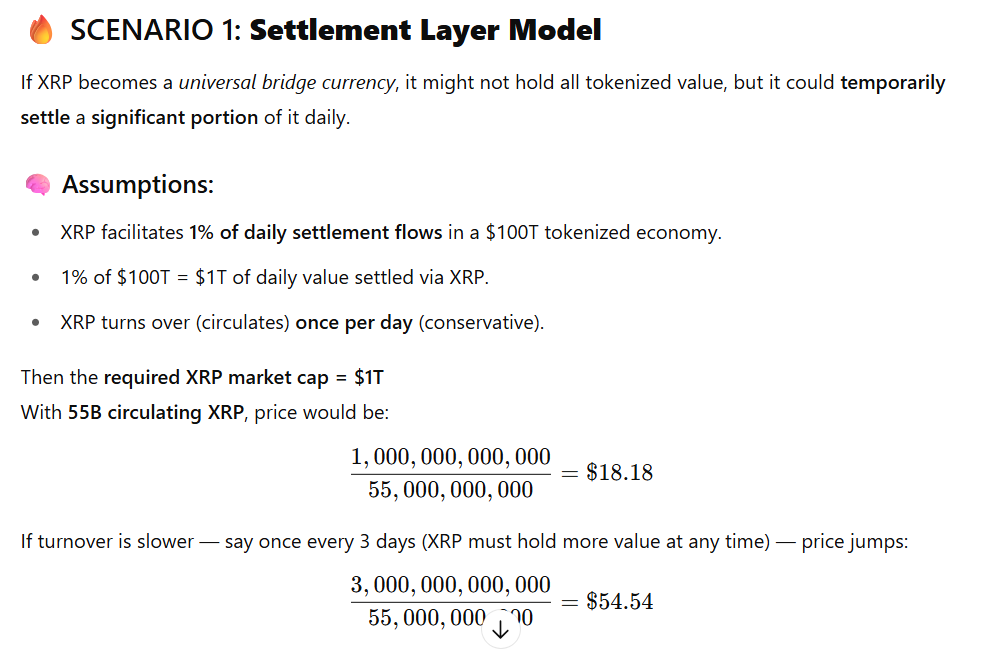

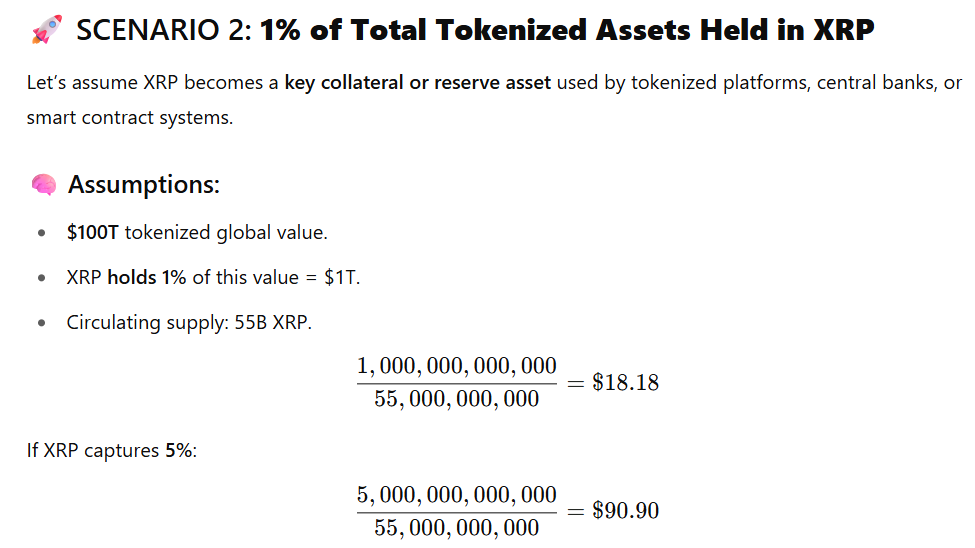

World asset tokenization fashions recommend XRP might additionally seize important worth if it turns into the bridge foreign money for tokenized economies. These XRP $2.42 prediction fashions develop to point out $18-26 targets if XRP facilitates 1-5% of a $100 trillion tokenized market. The calculations assume XRP would function a settlement layer for tokenized belongings worldwide.

The primary situation examines XRP’s potential as a settlement layer for day by day transaction flows in a tokenized economic system.

The convergence of technical evaluation supporting the XRP $2.42 prediction, regulatory developments by way of Ripple institutional banking initiatives, and in addition international asset tokenization potential creates a number of catalysts for this XRP value breakout goal situation.

Quiet strikes typically sign deep shifts, when escrow management and banking align, it builds a system positioning $XRP for scalable affect past the headlines.

— Caspian (@CaspianSpark) July 2, 2025

All Issues XRP stated:

“This isn’t simply massive—it might rewrite XRP’s future.”

Caspian additionally had this to say:

“Quiet strikes typically sign deep shifts, when escrow management and banking align, it builds a system positioning $XRP for scalable affect past the headlines.”