XRP has surged previous the $1.62 degree, inserting it lower than 5% away from the essential $2 mark. This spectacular rally has seen the value acquire over 50% since final Tuesday, capturing the eye of each buyers and analysts. The bullish momentum suggests the value may proceed its upward trajectory, fueled by rising optimism and powerful market sentiment. Nevertheless, such speedy features additionally convey potential dangers, notably in unstable circumstances.

CryptoQuant analyst Maartunn has highlighted important insights, suggesting that XRP’s current surge could be pushed by leveraged positions fairly than natural demand. A Leverage-Pushed Pump signifies heightened speculative exercise, which may result in sharp corrections if momentum weakens. As the value approaches multi-year highs, market members should navigate this situation cautiously, balancing enthusiasm with consciousness of attainable draw back dangers.

The approaching days will probably be pivotal for XRP because it nears the psychological $2 degree. A profitable breach of this mark may reinforce the bullish case, setting the stage for brand spanking new highs. Conversely, a failure to keep up present ranges may lead to elevated volatility and retracement. For now, it stays one of the intently watched belongings within the crypto market, with all eyes on its subsequent transfer.

Can XRP Bulls Maintain This Tempo?

XRP’s meteoric rise, surging over 285% in lower than 30 days, has sparked debate amongst buyers. Many are questioning whether or not the present tempo might be sustained by the excessive demand wanted to push costs additional. Whereas the rally has reignited optimism available in the market, skeptics counsel this might both result in a parabolic bull run or function an exit liquidity technique for whales.

Within the crypto area, exit liquidity refers to retail buyers who purchase right into a quickly rising asset, typically pushed by hype, permitting early buyers or whales to unload their holdings at larger costs. This idea raises considerations in regards to the sustainability of XRP’s rally, notably if natural demand can not preserve tempo with speculative momentum.

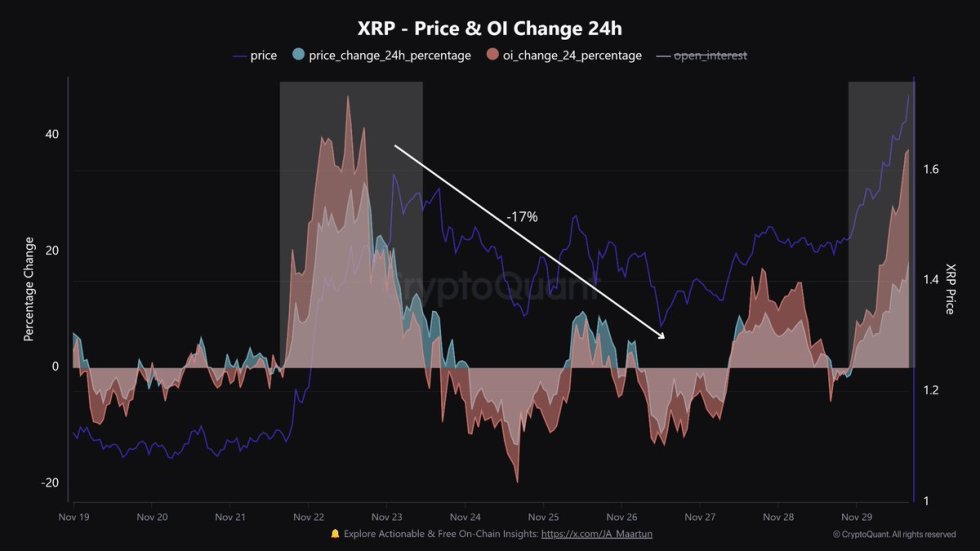

Maartunn has shared an intriguing perspective on XRP’s current efficiency. Analyzing value motion alongside Open Curiosity (OI) knowledge, he labeled the rally as a Leverage-Pushed Pump. OI has surged by 37% throughout this era, indicating a considerable rise in leveraged buying and selling exercise.

Whereas leverage can amplify features, it additionally introduces heightened volatility and danger. Maartunn famous {that a} related occasion up to now triggered a 17% drawdown, warning buyers to stay cautious.

As XRP approaches key psychological ranges, the subsequent steps will probably be essential. Buyers should weigh the potential for continued development towards the dangers of elevated leverage and attainable whale-driven selloffs.

Value Motion: Key Ranges To Watch

XRP is buying and selling at $1.92, breaking previous the important $1.60 resistance degree and persevering with its streak of recent highs. The value is now closing in on the earlier cycle’s high at $1.96, a degree that holds vital psychological and technical significance. This momentum has fueled optimism amongst buyers, who’re eyeing the $2 mark as a affirmation of XRP’s long-term bullish construction.

A breakout above $2 would solidify bullish sentiment, marking a important milestone in XRP’s ongoing rally. Such a transfer may pave the way in which for even larger value targets as confidence surges available in the market. Nevertheless, merchants stay cautious in regards to the potential for a retracement. If XRP fails to maintain features above $2, a correction may ship costs again to key help ranges, notably round $1.60, the place vital demand has been noticed.

The following few days will probably be important in figuring out whether or not the value can keep its upward trajectory or face a short lived pullback. Because the asset nears its all-important $2 mark, buyers ought to keep watch over buying and selling volumes and market sentiment, which can doubtless dictate XRP’s path within the brief time period.

Featured picture from Dall-E, chart from TradingView