At press time on April 10, some 2.74 billion XRP had been held on crypto exchanges, in line with knowledge retrieved by Finbold from market intelligence platform CryptoQuant.

This determine represents a 1-month low within the available XRP provide, which stood at 2.82 billion again on March 10.

Alternate provide tends to have an inverse correlation with costs. The much less tokens held on exchanges, the smaller the promoting strain.

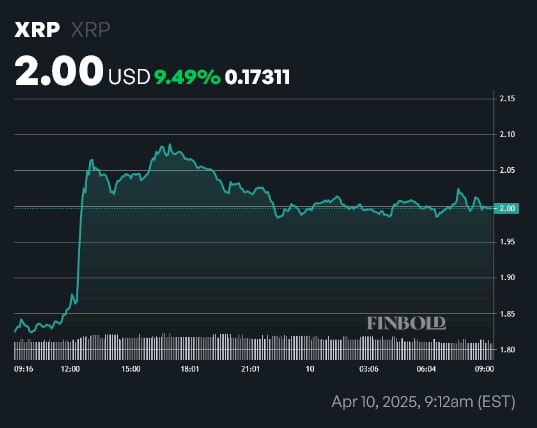

XRP was buying and selling at a worth of $2 on the time of writing, having reclaimed an important degree of assist within the wake of Donald Trump’s tariff pause, which brought on a rally throughout monetary markets

The current constriction in XRP provide has set the stage for a big worth transfer — however will it materialize?

Why XRP will extra probably than not commerce in tandem with the broader market

First issues first — it’s essential to maintain the bullish catalysts which might be in play in thoughts. XRP’s community exercise hit an all-time excessive on Wednesday, April 9. A day earlier, XRP futures quantity reached a month-to-month excessive of $21.6 billion, following a $500 million spike on Monday.

Furthermore, Tuesday, April 8, additionally noticed the discharge of the primary XRP exchange-traded fund (ETF), the Teucrium 2x Lengthy Day by day XRP ETF (NYSE Arca: XXRP). The fund noticed $5 million in buying and selling quantity on its first day, inserting it within the high 5% of ETF debuts.

Nonetheless, there’s a fairly vital stumbling block that can quickly come into play — and it, just like the change provide, has to do with XRP provide and demand dynamics. Ripple will unlock 1 billion tokens on Could 1, per the token’s escrow schedule.

Whereas many of the unlocked cryptocurrency just isn’t offered on open exchanges, the quantity that’s offered is to the tune of lots of of hundreds of thousands of tokens. Elevated promoting strain will most certainly blunt XRP’s upward trajectory, and in an atmosphere the place the cryptocurrency has to regain the $2.10 degree and preserve it so as to not lose bullish momentum, this might result in simply sufficient uncertainty to forestall a breakthrough.

Featured picture by way of Shutterstock