XRP’s current efficiency has earned it the highest place in Grayscale’s Crypto Snapshot, making it the best-performing cryptocurrency of the week.

Recent information from Grayscale Investments reveals that XRP outperformed main property like Stellar, Cardano, and Dogecoin to clinch the primary place in Grayscale’s Crypto Snapshot – Asset.

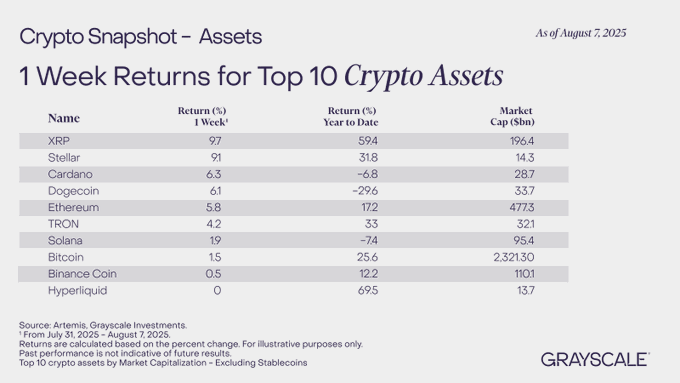

For context, the Crypto Snapshot – Belongings is a weekly report from Grayscale displaying the efficiency of the highest 10 cryptocurrencies, excluding stablecoins.

Newest updates from the SEC and Ripple lawsuit had a big impression on the efficiency of XRP this week. The token, which was progressively recovering from the widespread sell-off pushed by President Trump’s tariff replace, skilled a big surge after the SEC and Ripple requested the Second Circuit to dismiss their appeals.

Efficiency of Different High 10 Non-Stablecoin Cryptos

Consequently, XRP secured the highest place within the Grayscale Crypto Snapshot, outperforming Stellar and Cardano, which ranked second and third, respectively.

In keeping with the info, Stellar claimed the second place with a weekly acquire of 9.1%. Compared, Cardano’s worth grew 6.3% over the week, positioning it because the third-best performing cryptocurrency in Grayscale’s Crypto Snapshot.

High 10 finest performing cryptocurrencies | Grayscale

Notably, Dogecoin, Ethereum, Tron, and Solana occupied the fourth, fifth, sixth, and seventh positions, posting features of 6.1%, 5.8%, and 4.2% over the week.

Bitcoin sits close to the underside of the leaderboard, rating eighth among the many best-performing prime 10 non-stablecoin cryptocurrencies. As of August 7, the premier cryptocurrency noticed a modest acquire of only one.5% over the week.

BNB and Hyperliquid discovered themselves within the ninth and tenth positions on the leaderboard. Whereas BNB registered a slight development of 0.5% over the week, Hyperliquid didn’t see any acquire or loss in the identical timeframe. Regardless of having a flat efficiency this week, Hyperliquid nonetheless has the best year-to-date returns at 69.5%.