Abstract

On the day by day chart, the asset sits in a impartial market regime, with worth under the short-term shifting common however nonetheless comfortably above the long-term one. Momentum indicators present a lack of upside power however not an outright collapse, pointing to consolidation slightly than panic. Volatility stays important, with the typical true vary close to 100 models, so swings round key ranges will be sharp. In the meantime, the broader crypto market is recovering, with complete capitalization up strongly during the last 24 hours. Nevertheless, excessive Bitcoin dominance above 57% suggests capital continues to be extra centered on majors than area of interest tokens. General, traders seem cautious and selective, with the intense worry studying in sentiment information confirming a defensive stance.

Zcash privateness coin: Market Context and Route

The backdrop for this pair is formed by a crypto market price roughly 3.2 trillion {dollars}, after a stable one-day acquire of almost 4%. Furthermore, Bitcoin’s dominance at round 57% signifies that giant flows are gravitating towards the benchmark asset, leaving much less room for aggressive speculative rotations into privacy-focused names. That mentioned, durations of sturdy dominance typically precede phases when merchants begin trying to find greater beta alternatives, which may ultimately favor extra peripheral belongings.

The sentiment facet is extra fragile. The Concern & Greed Index sits in Excessive Concern territory at 22, signaling that many market members stay risk-averse and fast to promote into power. In distinction, such depressed sentiment traditionally creates the situations for oversold bounces and mean-reversion rallies, particularly when worth motion stabilizes above long-term averages. Subsequently, the present context suggests a cautious however probably constructive backdrop if promoting stress continues to fade.

Technical Outlook: studying the general setup

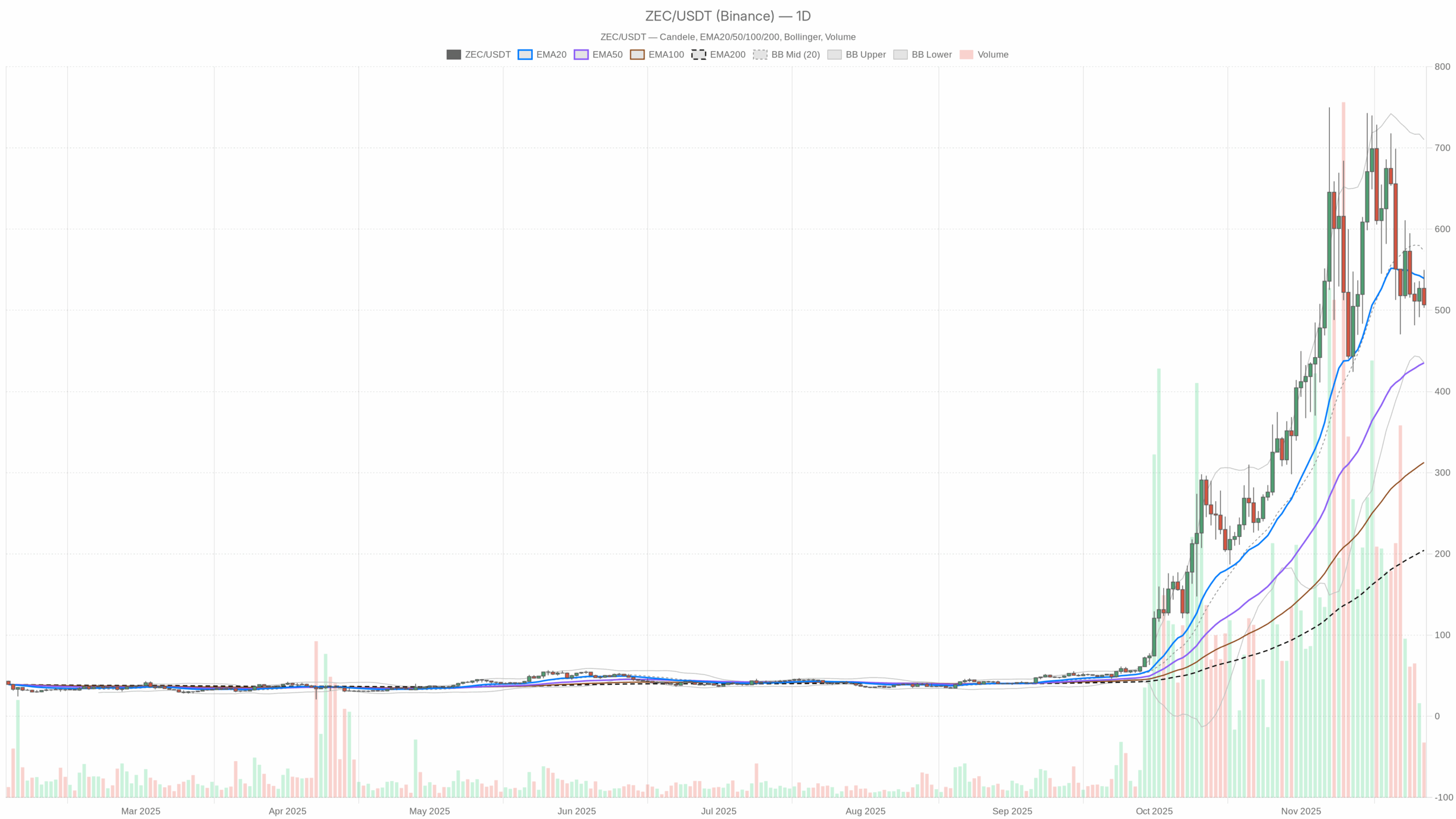

On the day by day timeframe, the asset closes close to 506.8, sitting under the 20-day exponential shifting common at about 539.3 however nonetheless above the 50-day EMA round 435.2 and much above the 200-day EMA close to 204.4. This configuration factors to a market the place the long-term uptrend stays intact, but short-term consumers have just lately misplaced management. If worth can reclaim the 20-day common, that might trace at development affirmation to the upside; failure to take action would maintain the tone corrective.

The day by day RSI at roughly 49 displays a market in equilibrium: neither overbought nor oversold. Nevertheless, its slight drift under the midpoint underlines that upside momentum has cooled, favoring a consolidation part during which dips could also be purchased however rallies may face fast revenue taking. This stability can final for a while, particularly when macro sentiment is cautious.

The MACD on the day by day chart reinforces this image. The primary line, round 28.5, has slipped underneath its sign line at 52.6, producing a detrimental histogram close to -24.1. This setup hints at momentum exhaustion after a previous advance, not but a confirmed bearish development. So long as the histogram doesn’t deepen considerably, the sign leans towards digestion of earlier beneficial properties slightly than a structural breakdown.

Bollinger Bands add one other layer. The worth now trades under the mid-band close to 572.9 however properly above the decrease band round 435.7. This means a pullback inside the band construction, the place sellers have the short-term edge however with out indicators of a full volatility-driven breakdown. Ought to worth slide towards the decrease band whereas RSI holds above oversold territory, it may arrange a possible mean-reversion rebound.

Every day ATR round 96.8 confirms elevated volatility. Such situations favor energetic merchants who can handle danger tightly, as volatility enlargement round assist or resistance may set off sharp directional strikes. Swing traders, in the meantime, could desire to attend for clearer affirmation that this volatility resolves both again into the prevailing longer-term development or right into a deeper correction.

Intraday Perspective and ZECUSDT token Momentum

On the hourly chart, the story turns extra cautious. Value round 506.8 sits under the 20, 50, and 200-period EMAs, clustered between roughly 514.6 and 558.8. This alignment alerts a short-term bearish regime, with intraday rallies repeatedly capped close to these descending averages. In the meantime, the hourly RSI close to 43.6 confirms that sellers retain the benefit, although situations aren’t extraordinarily oversold.

The hourly MACD helps this intraday stress: the road sits under the sign, with a detrimental histogram, indicating persistent however not explosive draw back momentum. Consequently, short-term merchants could proceed to fade bounces towards the hourly EMAs till the indicator flattens or crosses again up, signaling momentum rebalancing.

On the 15-minute chart, the image is analogous. Value hovers just below the quick EMAs and barely beneath the mid Bollinger Band, with an RSI close to 40. This configuration factors to a managed intraday downtrend slightly than capitulation. If decrease timeframes start carving greater lows whereas MACD stabilizes, it may foreshadow an try to retest hourly resistance areas.

Key Ranges and Market Reactions

On the day by day scale, the central pivot sits close to 519.9. Buying and selling slightly below this reference degree exhibits a market testing a stability level between bulls and bears. The primary resistance zone emerges round 536.8, near the short-term EMA, the place sellers are prone to defend and the place a clear break would sign a potential bullish breakout try. Above that, the center Bollinger Band close to 573 turns into the following vital check for development restoration.

On the draw back, preliminary assist seems round 489.9, the primary pivot assist. A sustained transfer under this space would open the door to a deeper check towards the decrease day by day band close to 435.7, the place consumers may attempt to reassert the broader uptrend. Intraday, the hourly pivot near 509.2 and its close by assist at 503.6 are instant reference ranges; swift reactions there can affirm whether or not short-term merchants are keen to build up on dips or nonetheless desire promoting into each rebound.

Future Situations and Funding Outlook

General, the principle state of affairs on the day by day timeframe stays impartial with a constructive long-term bias, as worth trades properly above the 200-day common however struggles with shorter EMAs. If the pair regains the 540 space and consolidates above it, the stability would tilt towards bullish continuation, supported by the long-term development. Conversely, repeated failures under the 520 pivot adopted by a break underneath 490 would favor a deeper corrective part, particularly whereas sentiment stays in excessive worry.

For traders, this implies positioning dimension and danger administration are extra vital than outright route calls. Longer-term members might even see volatility and worry as a possibility to build up step by step whereas the construction holds above key long-term helps. Shorter-term merchants, in the meantime, can give attention to the intraday bearish bias, promoting into rallies till momentum indicators sign that promoting stress has clearly exhausted.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding choices.