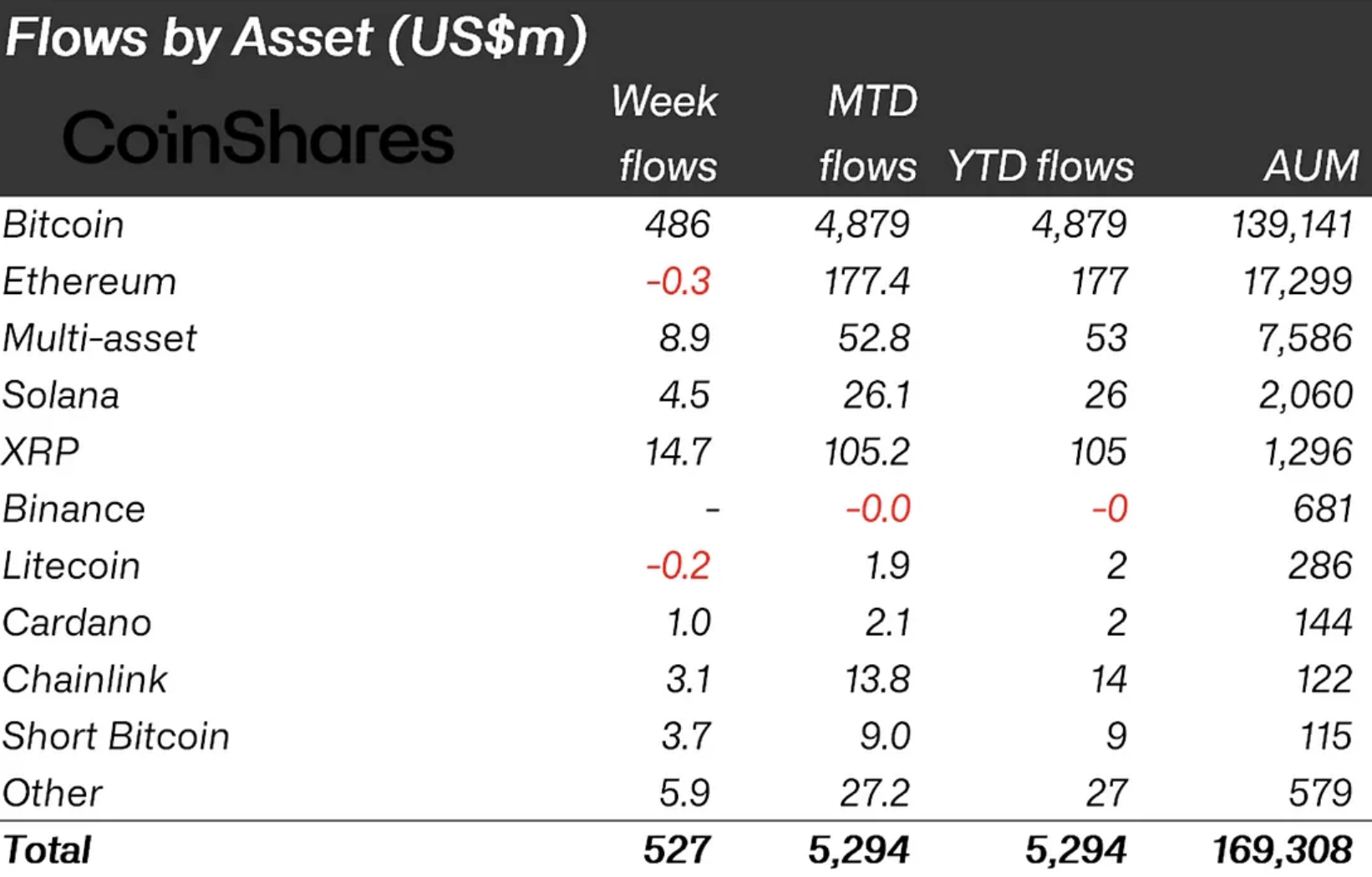

Here is the factor about crypto – it’s by no means boring. Final week, digital asset funding merchandise pulled in 527 million inflows, nevertheless it was not all that easy. Investor sentiment was everywhere, due to the same old market nervousness and, after all, all the excitement round DeepSeek. Bitcoin, as all the time, was the star with $486 million inflows, whereas quick Bitcoin merchandise added one other $3.7 million for the second week operating, in response to CoinShares.

However let’s speak about XRP. It has been fairly quiet for some time, however not anymore. It has had 105 million in inflows up to now this 12 months, with 15 million of that coming in simply the final week. That makes it the second-best-performing altcoin on the market, proper behind Ethereum.

Ethereum’s had a little bit of a tough patch lately, by the way in which. Regardless of a complete of $177 million inflows this 12 months, it ended final week with web zero flows. It had a little bit of a fall earlier within the week, most likely due to its hyperlinks to the tech sector, which took successful after Nvidia’s stumble. Add in some inner drama and a good bit of skepticism from its personal neighborhood, and Ethereum is wanting just a little shaky.

In the meantime, XRP has been quietly constructing momentum. Numerous that’s right down to Ripple, which has been making some huge strikes in cross-border funds.

It isn’t only a crypto factor anymore – Ripple has its fingers within the broader monetary market, backed by a stable community of institutional companions. And let’s not neglect the “Made in America” label, which could simply give XRP an edge as laws and tax guidelines maintain altering.

The actual deal? XRP is doing all this with out an ETF. That is proper, no exchange-traded fund, no downside. However the rumors of an XRP ETF are getting louder, and it seems like it’s extra a query of “when” than “if.” If that occurs, anticipate much more cash to circulate in.

May XRP ultimately problem Ethereum’s spot subsequent to Bitcoin? Perhaps.