In a narrative that is turning into too acquainted to crypto bulls, costs are sliding sharply on Thursday at the same time as gold and silver as soon as acquire notch new report highs.

Bitcoin BTC$110,901.10 has tumbled about 2% over the previous hour to $108,800, now principally having given up its bounce from the Friday crash. The motion throughout the remainder of crypto exhibits even steeper declines, with ether ETH$4,007.20, XRP$2.4115 and solana SOL$192.94 amongst these sporting roughly 3% dips over the past sixty minutes.

Treasured metals, nevertheless, proceed to be extraordinarily nicely bid, with gold greater by one other 2% to a brand new report slightly below $4,300 per ounce. Silver is forward 3.6% and likewise at a brand new report.

What offers?

Questioning what’s conserving bitcoin BTC$110,901.10 and different main tokens underneath stress after final week’s much-needed flush out of extra leverage?

The probably catalyst is the tightening liquidity within the monetary system, which appears to be tempering investor threat urge for food.

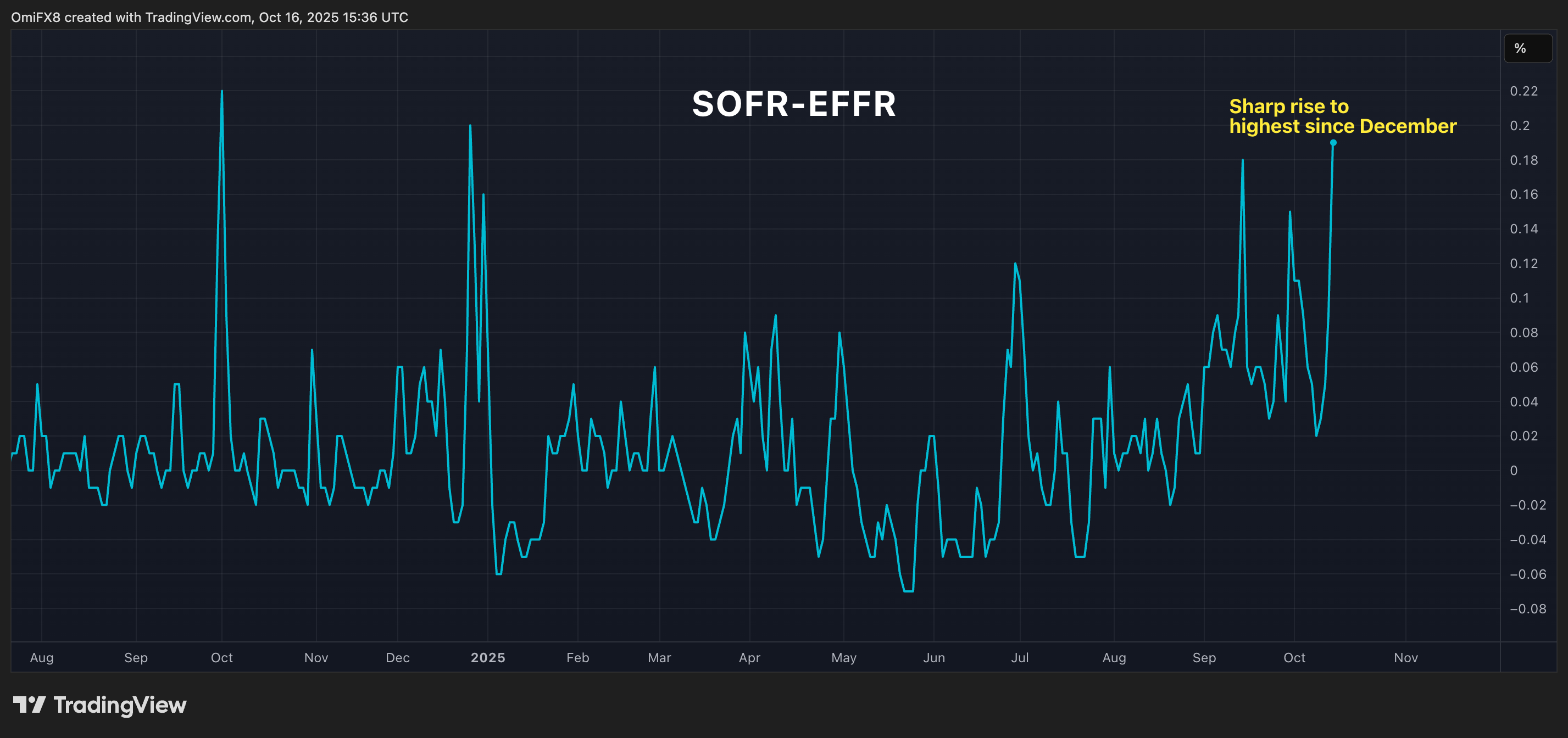

The continuing tightening is obvious from the unfold between secured in a single day financing charge (SOFR) and the efficient federal funds charge (EFFR), which has risen to 0.19 from 0.02 in a single week, reaching the best since December 2024, in response to knowledge supply TradingView.

SOFR represents the price of borrowing money in a single day utilizing U.S. Treasury securities as collateral within the repo market. The debtors are sometimes banks, broker-dealers, asset managers, cash market funds, and insurance coverage firms. SOFR is taken into account nearly risk-free, secured charge primarily based on precise transaction knowledge.

In the meantime, EFFR signifies the weighted common rate of interest at which banks lend extra reserves to different banks in a single day within the federal funds market. It’s an uncollateralized, unsecured interbank lending charge, influenced primarily by the Federal Reserve’s financial coverage.

When the SOFR rises above the EFFR, it signifies that lenders are demanding the next return even for secured borrowing backed by U.S. Treasury securities. This case alerts tight liquidity situations and makes borrowing dearer within the quick time period.

The most recent spike within the unfold might be capping good points in BTC, which is taken into account a pure liquidity play by many.

SOFR-EFFR unfold. (TradingView)

Observe that the unfold remains to be significantly decrease than the excessive of two.95 noticed through the repo disaster of 2019.

That mentioned, different indicators of funding stress are current, too. As an example, on Wednesday, banks drew $6.75 billion from the standing repo facility (SRF), the best quantity because the finish of the coronavirus pandemic, excluding quarter-end intervals.

The SRF, launched in 2021, offers a liquidity backstop throughout potential funding shortfalls by extending twice-daily in a single day money loans towards U.S. Treasuries.

All these indicators of tightening liquidity have sparked hope throughout crypto social media that central banks would possibly quickly step in to ease the stress, probably recharging BTC bulls’ engines for a contemporary rally to new highs. Whether or not that performs out because the bulls anticipate stays to be seen.