Simon Kim, founding father of enterprise capital agency Hashed, has launched a real-time dashboard that estimates Ethereum’s honest worth at $4,747.4. With Ethereum buying and selling at $3,022.3, the instrument suggests an undervaluation of 56.9%. The dashboard updates each two minutes and makes use of eight distinct valuation fashions.

The Ethereum Valuation Dashboard combines strategies from conventional finance and crypto-native evaluation. Kim goals to offer a rigorous valuation method, reflecting broader institutional curiosity in elementary evaluation in crypto markets.

Dashboard Combines Conventional and Crypto-Native Valuation Strategies

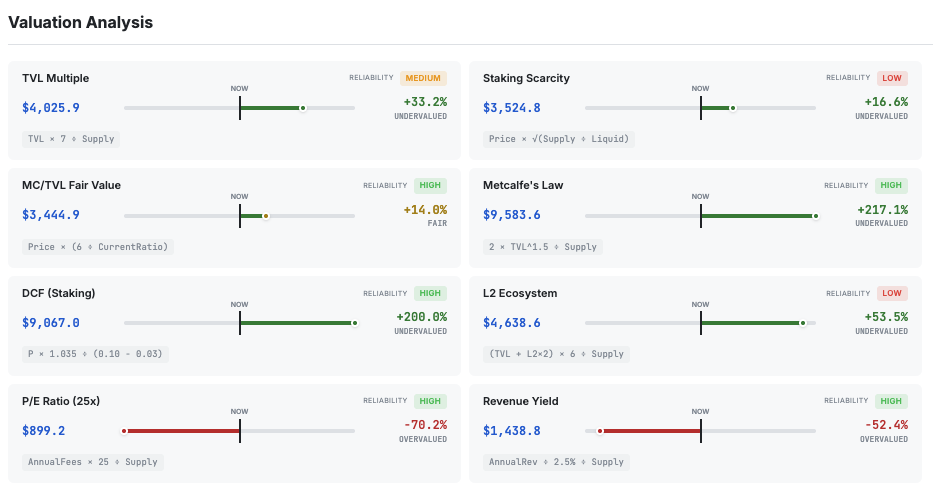

Kim’s dashboard incorporates eight fashions to evaluate Ethereum’s intrinsic worth. Conventional finance strategies embody Discounted Money Stream (DCF), which depends on staking yields, a Worth-to-Earnings (P/E) ratio set at 25x, and Income Yield evaluation. Institutional buyers have lengthy used these instruments to guage equities and bonds.

The dashboard additionally makes use of crypto-specific metrics designed to seize blockchain dynamics. These embody Complete Worth Locked (TVL) A number of, Staking Shortage, Market Cap to TVL Honest Worth, Metcalfe’s Legislation, and Layer 2 ecosystem valuation. 21Shares analysis notes that network-based fashions are gaining reputation as establishments search to quantify blockchain adoption and its results.

Metcalfe’s Legislation, which holds that community worth grows with the sq. of the person base, yielded the best valuation of $9,583.6 and indicated that Ethereum was 217.1% undervalued. The DCF mannequin arrived at $9,067.8—a 200% undervaluation. But the P/E Ratio mannequin recommended Ethereum is 70.2% overvalued at $899.2, and Income Yield indicated a 52.4% overvaluation at $1,438.8.

The composite honest worth of $4,747.4 is calculated by weighting every mannequin by reliability—high-reliability fashions are 9 occasions extra influential, medium 5 occasions, and low 2 occasions. These scores yielded 5 purchase indicators, one maintain, and two promote indicators throughout the eight fashions.

Excessive reliability fashions embody MC/TVL Honest Worth, Metcalfe’s Legislation, DCF (Staking Yield), P/E Ratio, and Income Yield. TVL A number of is rated medium reliability, whereas Staking Shortage and Layer 2 Ecosystem fashions rank as low reliability.

This method highlights the issue of valuing cryptocurrencies. Whereas conventional metrics like P/E ratios and income multiples provide confirmed methodologies, they might miss essential community dynamics. Crypto-native instruments akin to Metcalfe’s Legislation suggest frameworks rooted in blockchain adoption, although precisely gauging person exercise stays a hurdle.

Market Information Reveals Shifting Ethereum Fundamentals

Present market information exhibits Ethereum priced at $3,022.3 with a market cap of $365.4 billion and a 24-hour quantity of $21 billion. The worth stays 38.8% beneath the all-time excessive of $4,946.1. Ethereum’s market dominance is 16%, and the ETH/BTC ratio has dropped 24.7% year-over-year to 0.03243. The dashboard additionally exhibits Ethereum’s circulating provide and change reserves, in addition to on-chain exercise, together with TVL and the staked quantity of ETH.

What’s ETH truly price?

The crypto trade deserves higher than worth hypothesis.

I constructed a dashboard to consider ETH’s intrinsic worth with 8 fashions:https://t.co/k6F8eMtyvo

Removed from excellent and open to suggestions.

Should you like this initiative, please share it 🙏— Simon Kim (@simonkim_nft) November 26, 2025

Kim, CEO and Managing Companion of Hashed, has positioned the agency as a frontrunner in blockchain enterprise capital. His credentials embody talking at main trade occasions, such because the AI Crypto Summit 2025 and KOOM 2025, the place he represents Hashed’s technology-driven funding focus.

Outstanding disclaimers on the dashboard stress that each one valuation fashions have limitations. The instrument advises buyers to contemplate a variety of things past quantitative evaluation alone. This displays the challenges of making use of legacy frameworks to a quickly evolving asset class.

Current worth strikes reinforce the necessity for sturdy evaluation. ZebPay technical evaluation experiences that Ethereum broke free from a $2,350 to $2,750 buying and selling vary in late November 2024, surging nearly 25% to $3,442 earlier than discovering assist at $3,015. Key resistance sits at $3,750, whereas $3,000 acts as essential assist.

The publish Hashed’s Simon Kim Says Ethereum Is 57% Undervalued appeared first on BeInCrypto.