Ethereum (ETH) might be poised for a brand new report excessive because the second-ranked cryptocurrency by market cap mimics Bitcoin’s (BTC) previous bull run.

Ethereum has but to hit a report excessive within the present market cycle, whereas Bitcoin has reached an all-time excessive shy of the $100,000 milestone.

Now, Ethereum’s present technical setup is mimicking Bitcoin’s 2014-2017 trajectory, the place each property skilled an identical bear market section, adopted by the early phases of a bull cycle, in response to buying and selling knowledgeable TradingShot’s evaluation shared in a TradingView submit on November 29.

Due to this fact, Ethereum would possibly comply with a well-established path to new highs if this value motion have been to play out.

In line with the evaluation, the cycle begins with Ethereum’s backside formation under the 200-week shifting common (MA), adopted by a rally supported by the 50-week shifting common. Subsequent is a second rally throughout the 0.786 to 0.5 Fibonacci vary.

The defining second emerged with Ethereum’s bullish crossover in October 2024, which mirrors Bitcoin’s October 2016 sign that led to a parabolic surge.

Ethereum’s value subsequent goal

Trying forward, Ethereum could be focusing on the ultimate section of this motion, doubtlessly reaching the two.382 Fibonacci degree—an astonishing value above $50,000, though the timeline has not been specified.

“For Bitcoin that peaked close to the two.382 Fibonacci extension. If that appears unrealistic for Ethereum’s value at the moment (the two.382 Fib is simply above 50k!!) by way of market cap (and rightly so), simply take into account the affect that the ETFs’ capital inflows have in the marketplace. It stays to be seen, however nonetheless, ETH has monumental upside,” the knowledgeable famous.

If Ethereum hits this value goal, the asset will management a market capitalization of over $6 trillion, putting the digital foreign money because the second-ranked asset globally behind gold, offered different asset courses expertise minimal development.

Whereas such a valuation might sound bold, contemplating the latest institutional curiosity, the asset might see capital influx.

As an example, important inflows into the Ethereum spot exchange-traded fund (ETF) helped ETH breach the $3,600 resistance for the primary time in over 5 months.

On the identical time, crypto buying and selling knowledgeable CrediBULL warned that Ethereum will doubtless crash in direction of the $3,000 degree. He famous that the asset’s value trajectory will primarily be dictated by how Bitcoin trades.

ETH value evaluation

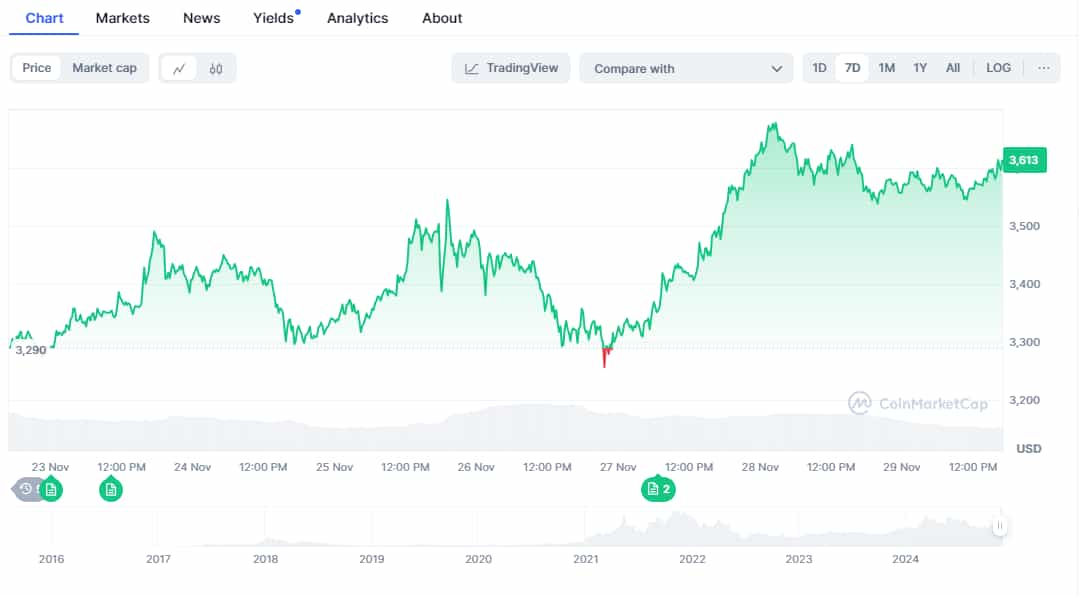

By press time, Ethereum was buying and selling at $3,609 with day by day features of about 0.1%, whereas on the weekly timeframe, ETH is up nearly 10%.

In abstract, Ethereum seems to be bullish within the quick time period, however the $3,600 resistance wants to carry to validate the bullish sentiment.

Featured picture by way of Shutterstock